11 May 2020

Northern Ireland PMI - Severe declines in output and new orders recorded in April

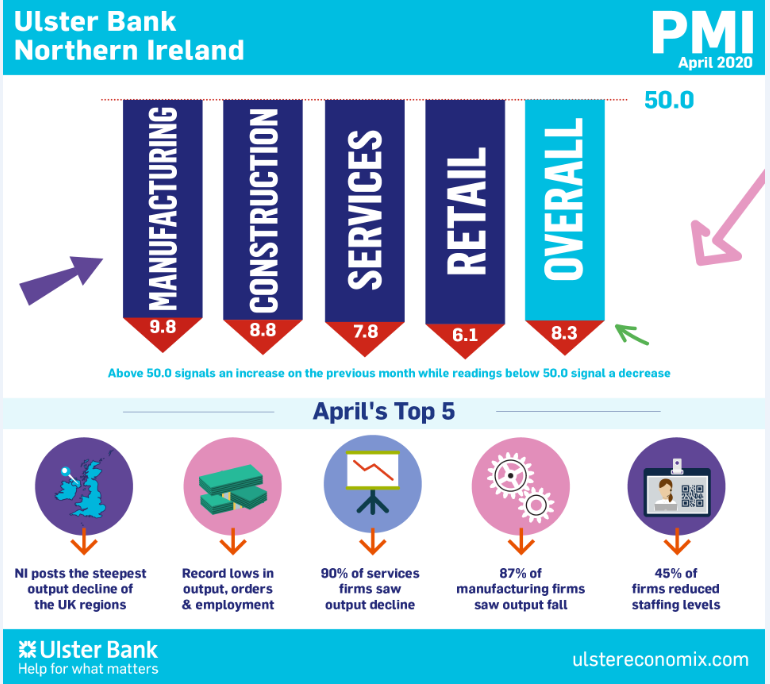

The April Ulster Bank Northern Ireland PMI® report - produced for Ulster Bank by IHS Markit - pointed to a severe contraction of the Northern Ireland private sector, and one that was by far the worst since the survey began in August 2002. Output and new orders were particularly badly affected amid company shutdowns, while confidence around the 12-month outlook continued to fall.

Commenting on the latest survey findings, Richard Ramsey, Chief Economist Northern Ireland, Ulster Bank, said:

"The PMI surveys are the first fact-based indicator of regional economic health each month. They track changes in the rate of growth - as opposed to levels of activity - across a range of indicators relative to the previous month. With a full lockdown maintained throughout April, it came as no surprise that all twelve UK regions posted record rates of decline in output and employment. Northern Ireland's private sector reported an additional raft of record rates of decline with new orders, exports, backlogs and business confidence. Furthermore, the rates of decline in output and new orders amongst local firms were steeper than elsewhere across the UK.

"Interestingly, however, Northern Ireland's rapid rate of decline in employment was not as sharp as most other UK regions. Other survey evidence suggests that Northern Ireland's uptake of the Job Retention Scheme - and the process of furloughing staff - has been notably higher than the national average. Just over half (52%) of local firms left workforce numbers unchanged. Nevertheless, it is still worrying that even with unprecedented levels of government job support, employment is still falling at a record pace. Around 45% of local firms reported that they reduced their headcount in April.

"Until this pandemic struck, figures in the 20s were extremely rare. However, post the start of the COVID-19 pandemic we have seen PMI readings around the world fall into the teens and even a few into single digits. Northern Ireland's headline indicator of business activity collapsed to 8.3 last month. All four monitored sectors recorded business activity readings below 10. So what does this actually mean?

"Prior to COVID-19, the lowest PMI reading for business activity in Northern Ireland was 32.1 in January 2009. The lowest manufacturing and services readings were 29.5 and 35.9 respectively. The scale of the collapse in demand in April relative to 2009 is clear when looking at the proportion of firms reporting a fall in output. Around 87% of manufacturing firms and 90% of service sector firms reported a decline in output in April relative to March. Back in January 2009 the corresponding percentages were 44% (Manufacturing) and 48% (Services). The speed and scale of the current slump is of a much greater magnitude than the last recession.

"From an employment perspective, the key difference with this downturn is the scale of the job losses within the services sector. 42% of firms reported a reduction in headcount in April. Back in January 2009 just over 1 in 7 firms were shedding staff. Meanwhile manufacturers are reporting similar rates of job losses, 39% versus 37% in January 2009. Remember these readings are with the Job Retention Scheme in place. What happens when this safety net is removed is a major cause for concern.

"April will undoubtedly mark the low watermark with all of the UK PMI surveys. It provides an extremely low base which private sector growth in May will be measured against. As a result, we can expect to see some strong rates of output growth in the coming months but this must be interpreted with caution. The key point is that actual levels of activity will remain extremely weak for some time. Job losses are expected to surge in the second half of 2020. Returning to the levels of private sector activity and employment that existed before the pandemic will take years not months. COVID-19 will leave scars on the economy that will last even longer."

The full report for NI, and a report the UK Regional comparisons, are available to download below.

Source: Richard Ramsey, Chief Economist Northern Ireland, Ulster Bank.

Downloads

Sexual Harassment – 'Preventative Duty’

Sexual Harassment – 'Preventative Duty’

25 November 2024

The Worker Protection Act 2023 (Amendment of the Equality Act 2010), is UK legislation designed to enhance protections against workplace sexual harassment.

INTERGRAF OPENS APPLICATIONS FOR THE 2025 YOUNG TALENT AWARD

INTERGRAF OPENS APPLICATIONS FOR THE 2025 YOUNG TALENT AWARD

4 December 2024

Intergraf is pleased to announce that applications are now open for the 2025 Young Talent Award, an initiative designed to inspire and shape the future of the print industry. This year, the Award invites young talent to explore how print companies can effectively attract and engage younger generations to pursue careers in the print industry.