14 July 2020

Northern Ireland PMI - rate of decline in activity slows sharply in June

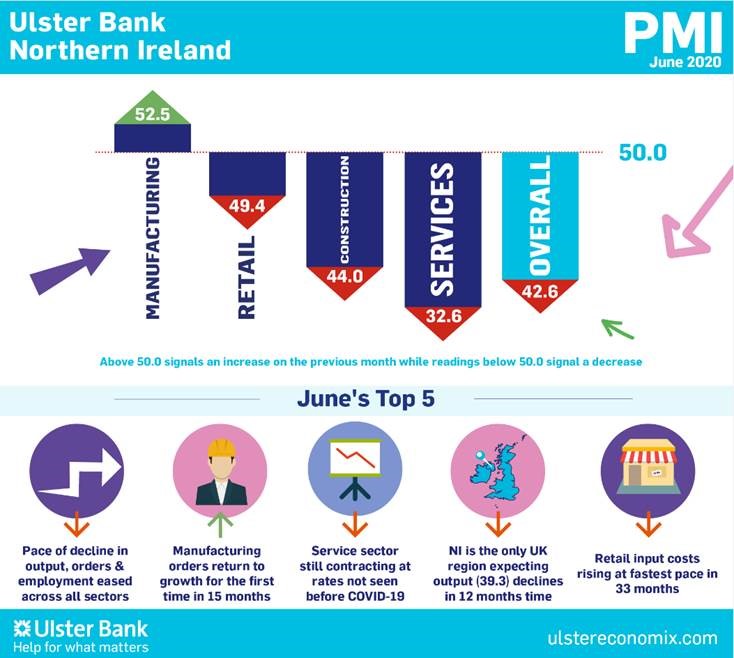

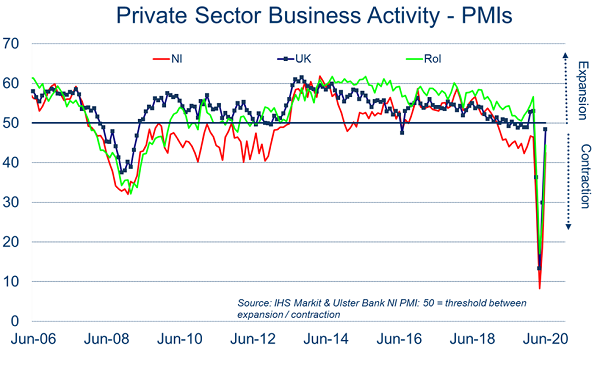

The latest Ulster Bank Northern Ireland PMI® report (for June) - produced for Ulster Bank by IHS Markit - indicated that the Northern Ireland private sector continued to be impacted by the coronavirus disease 2019 (COVID-19), seeing further reductions in output, new orders and employment. That said, rates of decline softened amid a loosening of lockdown restrictions.

Commenting on the latest survey findings, Richard Ramsey, Chief Economist Northern Ireland, Ulster Bank, said:

"June marked the end of a quarter Northern Ireland’s private sector has never seen the like of before. Unsurprisingly the latest Ulster Bank Northern Ireland PMI therefore confirms record rates of decline in output, orders, exports and employment during this period. But while the quarterly data is bleak, this conceals tentative signs of a recovery on a month-to-month basis.

"April, the first full month of lockdown, marked the all-time-low with rates of decline in output easing in May. A loosening in the lockdown restrictions in June has seen this trend continue. Indeed, last month was the first time in eight months that any sector returned to growth.

"Manufacturing was the best performer in June, reporting expansion in output and orders for the first time in eight and fifteen months respectively. 46% of local manufacturers reported an uptick in output in June. While manufacturing remains a bright spot for output and orders growth, it remains a black spot for employment though. Staffing levels continued to fall at a rapid pace in June with firms cutting staff outnumbering those increasing their headcount by four to one.

"It is a similar picture within retail, with sales activity stabilising but firms still cutting staff at a rapid rate. Retail and the hospitality sector (part of services) have been the most adversely affected by the social distancing / lockdown restrictions. Reopening of businesses has been accompanied by a surge in costs linked to personal protective equipment (PPE). Retailers saw their input costs rise at the fastest rate in 33 months.

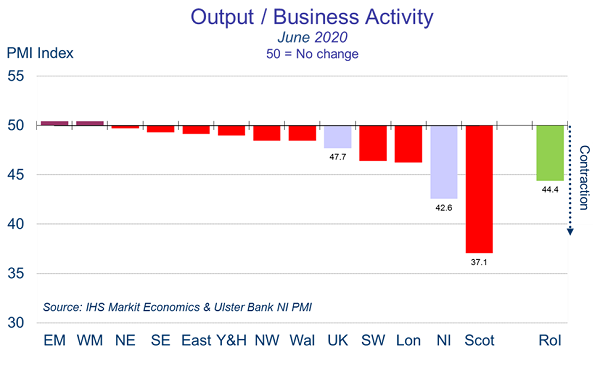

"The continued lockdown of the hospitality industry in June weighed on the wider services sector. Last month services firms continued to report rates of contraction in output and orders not seen before COVID-19. It is noted that fewer than 1 in 4 service sector firms reported a pick-up in business activity in June. This should improve significantly in July with the reopening of bars and restaurants. Measures announced in the Chancellor’s Economic Statement such as the temporary reduction in the VAT rate from 20% to 5% will also provide a much-needed shot in the arm for the hospitality sector. It may also help boost confidence in Northern Ireland’s private sector which continues to be the most pessimistic region in the UK for output growth in 2021."

The main findings of the June survey were as follows:

The headline seasonally adjusted Business Activity Index rose to 42.6 in June, up sharply from the reading of 18.9 in May and thereby signalling a much softer reduction in output. That said, the fall in activity in Northern Ireland was the second-sharpest of the 12 UK regions, behind only Scotland. Manufacturing production returned to growth, while the remaining three sectors all posted softer reductions in activity. Services saw the steepest decline. New orders continued to fall sharply, although as was the case with business activity the rate of contraction softened further from April's survey record. The COVID-19 pandemic led to a further decline in new export orders, and one that was steeper than that seen for total new business.

Employment decreased for the fourth month running amid a lack of new work. The rate of job cuts in Northern Ireland remained softer than the UK average. June saw a sharp and accelerated increase in input costs, with higher prices linked to items such as PPE which were required to support business reopening. Meanwhile, output prices were broadly unchanged, ending a three-month sequence of falling charges. Companies remained pessimistic regarding the 12-month outlook for output amid concerns about the long-term impacts of COVID-19.

The full report for NI, and a report the UK Regional comparisons, are available to download below.

Source: Richard Ramsey, Chief Economist Northern Ireland, Ulster Bank.

Downloads

POSITIVE Q4 OUTPUT AND ORDERS GROWTH IN-LINE WITH FORECAST – BUT A NOSEDIVE IN CONFIDENCE HAS DEPRESSED EXPECTATIONS FOR Q1

POSITIVE Q4 OUTPUT AND ORDERS GROWTH IN-LINE WITH FORECAST – BUT A NOSEDIVE IN CONFIDENCE HAS DEPRESSED EXPECTATIONS FOR Q1

6 February 2025

Output and orders in Q4 more-or-less performed as forecast as the UK's printing and printed packaging industry continued its path of steady, but subdued, growth in 2024.

New research charts the transition from offset to digital print

New research charts the transition from offset to digital print

27 February 2025

In The Future of Digital vs. Offset Printing to 2029 Smithers examines how competing digital and offset printing technologies contend for market share. The new report quantifies the market by print process, end-use application, and region.