14 September 2020

Northern Ireland PMI - activity increases, but new orders take a step back

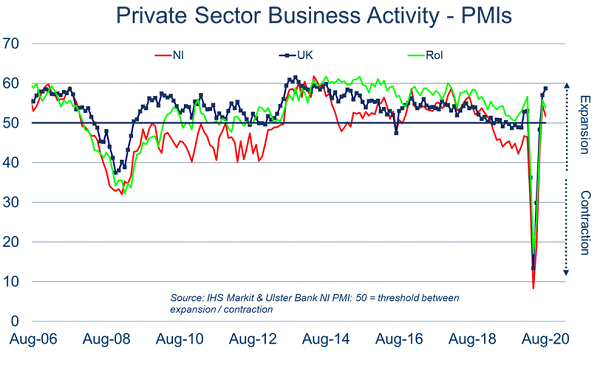

The August data from the Ulster Bank Northern Ireland PMI - produced by IHS Markit - indicated that although business activity increased for the second month running, the rate of expansion softened amid signs of a stalling in the recovery in new orders. There remained further evidence of spare capacity, which led to a sharper reduction in employment. The rate of cost inflation quickened, but firms lowered their selling prices to try and attract new business.

Commenting on the latest survey findings, Richard Ramsey, Chief Economist Northern Ireland, Ulster Bank, said:

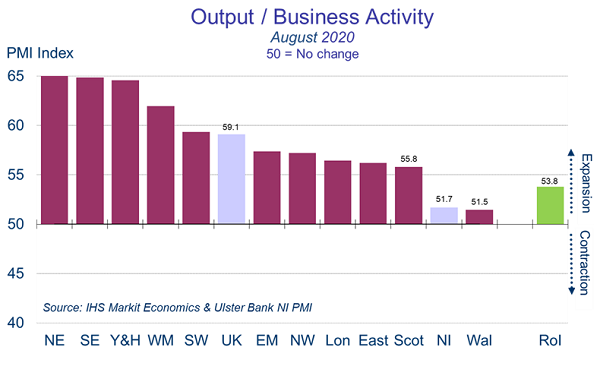

"PMIs in four English regions posted growth rates in the ‘60s' in August, with the North East (66.0) and the South East (64.9) recording their fastest rates of growth on record. Hopes of a ‘V-shaped' recovery remain intact in these regions; but the same is not the case in Northern Ireland. All of the headline indicators for Northern Ireland's private sector deteriorated in August relative to July. Business activity slowed from an encouraging 54.5 in July to 51.7 last month. After Wales, this was the weakest rate of growth of any UK region. Interestingly, the Devolved Regions - who were more cautious in lifting lockdown restrictions - continue to lag their English counterparts.

"In Northern Ireland, both retail and construction saw activity fall back from July's strong ‘reopening' rebound. Meanwhile manufacturing notched up its third successive month of growth albeit at a weaker rate than July. Significantly, the local services sector saw its first month of growth since the pandemic started. However, the scale of the rebound was much weaker than anticipated despite the boost from initiatives such as the Eat Out to Help Out scheme. Indeed, Northern Ireland's service sector recovery is lagging well behind the UK and is mirroring the lacklustre performance of the Republic of Ireland's service industry.

"While the recovery in output has at least begun, albeit not as rapid as had been hoped for, the start of a labour market recovery remains a long way off. Northern Ireland's private sector saw employment fall for the sixth month running in August and with the furlough scheme due to end, this trend looks set to continue. All four sectors cut their staffing levels in August with manufacturing reporting the most significant reductions in headcount.

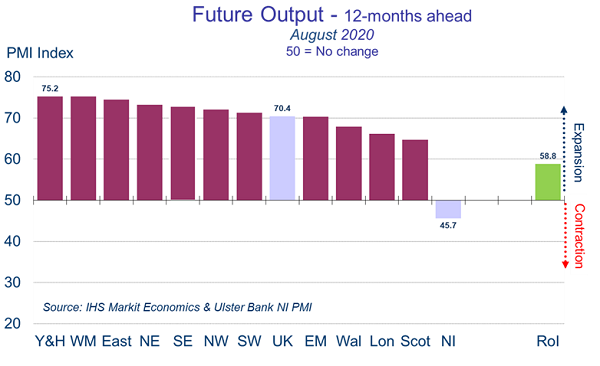

"Overall, Northern Ireland's loss of momentum in August does not look temporary. New orders fell at a significant rate in August after rising in July for the first time in eighteen months with the rate of contraction most marked within export markets. The rise in the number of cases of COVID during September to date, combined with the heightened tensions surrounding Brexit, make the landscape a very challenging one."

The main findings of the August survey were as follows:

At 51.7 in August, the headline seasonally adjusted Business Activity Index was above the 50.0 no-change mark for the second month running. That said, the reading was down from 54.5 in July to signal a weaker increase in output. A number of respondents signalled that they were catching up on work delayed during the lockdown. Manufacturing production growth was sustained, while services activity rose for the first time in a year-and-a-half. Both the construction and retail sectors saw activity pause following rebounds in July. New orders took a step back, falling following a return to growth in July. That said, the reduction was much softer than seen during the worst of the coronavirus disease 2019 (COVID-19) downturn.

Employment continued to fall sharply, with some firms reporting redundancies due to the pandemic. The rate of job cuts quickened from July. The return of some staff from furlough and COVID-19 related expenses resulted in a further increase in input costs, the sharpest in five months. On the other hand, output prices continued to fall. Companies remained pessimistic around the 12-month outlook for output, with the longer-term impacts of COVID-19 the main cause for concern.

POSITIVE Q4 OUTPUT AND ORDERS GROWTH IN-LINE WITH FORECAST – BUT A NOSEDIVE IN CONFIDENCE HAS DEPRESSED EXPECTATIONS FOR Q1

POSITIVE Q4 OUTPUT AND ORDERS GROWTH IN-LINE WITH FORECAST – BUT A NOSEDIVE IN CONFIDENCE HAS DEPRESSED EXPECTATIONS FOR Q1

6 February 2025

Output and orders in Q4 more-or-less performed as forecast as the UK's printing and printed packaging industry continued its path of steady, but subdued, growth in 2024.

New research charts the transition from offset to digital print

New research charts the transition from offset to digital print

27 February 2025

In The Future of Digital vs. Offset Printing to 2029 Smithers examines how competing digital and offset printing technologies contend for market share. The new report quantifies the market by print process, end-use application, and region.