5 March 2021

Economic and Budget Overview - March 2021

Executive Summary

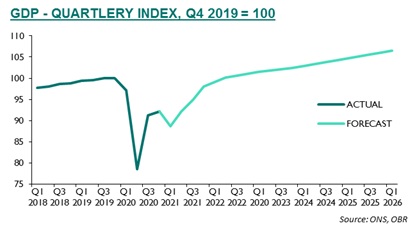

- Economic recovery to recover to pre-pandemic levels by mid-2022.

- Covid rescue funding increased to £344 billion.

- Budget introduces tax incentives of £27 billion to support the recovery.

- Tax rises implemented to repair public finances over the long-term.

- Tax hikes not expected to reduce debt until 2025.

UK Economic Summary

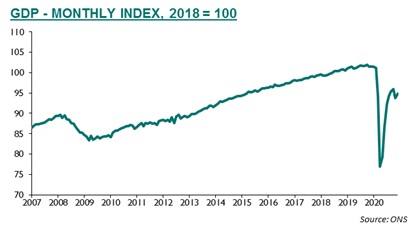

Economic output (GDP) suffered greatly with the onset of the pandemic but did start to recover strongly in mid-2020. Unfortunately the speedy recovery has been blockaded by resurgent virus towards the end of 2020 and the strengthened lockdown into 2021. This means that recent economic performance has more closely matched downside forecasting scenarios; as opposed to the central or upside paths. Over the year 2020 as a whole, GDP contracted by 9.9%; the largest annual fall in UK GDP on record.

Unemployment has risen from 4% in early 2020 to 5.1% at the end of 2020. Much lower than might have been expected - however, there were 4.7 million workers on furlough in January 2021.

The Budget: Rescue, Recovery and Repair

On 3rd March 2021 Chancellor Rishi Sunak delivered the Spring Budget. The policy measures can be broadly categorised into three areas - rescue, recovery and repair.

Rescue

Virus-related rescue support for households, businesses and public services has been extended. An extra £44 billion to the covid rescue package brings the total direct cost to £344 billion.

Almost half of the funding total has been to the NHS and related public services; one-third has been support to households via the furlough scheme, self-employment grants and

Universal Credit increases; the remaining fund has been provided to businesses in the form of grants, business rates holidays and government-guaranteed loans.

|

The Coronavirus Job Retention Scheme The furlough scheme will be extended until the end of September. Employees will continue to receive 80% of their current salary for hours not worked. There will be no employer contributions - beyond National Insurance contributions (NICs) and pensions - required in April, May and June. From July, the government will introduce an employer contribution towards the cost of unworked hours of 10% in July, 20% in August and 20% in September, as the economy reopens. |

Recovery

A temporary tax break has been introduced to encourage businesses to bring forward investment expenditure into 2021 and 2022. The two-year 130% super deduction to corporation tax for investments in plant and machinery is expected to cost £27 billion and is expected to be a very strong incentive for businesses to invest now rather than later.

|

Super Deduction From 1 April 2021 until 31 March 2023, companies investing in qualifying new plant and machinery assets will benefit from a 130% first-year capital allowance. This upfront super deduction will allow companies to cut their tax bill by up to 25p for every £1 they invest. Investing companies will also benefit from a 50% first-year allowance for qualifying special rate (including long life) assets. |

Repair

There a number of measures to repair the damage to public finances: increases to corporation tax, a freeze on personal income tax thresholds and a reduction in departmental expenditure plans.

The biggest contribution will come from the changes to corporation tax.

|

Corporation Tax The rate of corporation tax will increase from April 2023 to 25% on profits over £250,000. The rate for small profits under £50,000 will remain at 19% and there will be relief for businesses with profits under £250,000 so that they pay less than the main rate. |

For information on the measures unveiled in the Budget please read Budget Spring 2021 - What does it mean of print?

UK Economic Outlook

Whilst recent economic performance has tended to the downside, there are some reasons to be optimistic for a pick-up in future economic growth; though some mixed and negative factors may still have influence.

Vaccines

The approval, acquisition and rollout of vaccines continues to gather steam. More than one-third of the adult population has been vaccinated, the vaccines are proving to be effective and the Government is targeting to have offered everyone over 50 a first does by 15 April and all adults by 31 July.

Adaptation

The economy has become increasingly adaptive to the introduced public health restrictions.

Consumer spending under recent lockdowns had been much closer to pre-pandemic levels. With an acceleration towards online shopping; consumers have also changes the way in which they spend. Businesses have also adapted by making shops and workplaces covid-secure and remaining open, subject to the enforced restrictions.

Government support

The extension of the furlough scheme, amongst the other economic support measures, and a strong recovery in business investment are expected to further support economic recovery.

EU Exit

A Brexit deal was reached that was broadly in line with assumed expectations and will be expected to allow uncertainty to reduce. However, the lateness of the deal being reached, and the reluctance for greater temporary tolerance, means that the implementation has been more disruptive to trade than many forecasts will have allowed for.

Economic output (GDP) in Q1 2021 is expected to be limited by the lockdown imposed in January 2021, such that a 3.8% reduction in GDP is expected. However, growth is expected to rebound strongly as public health restrictions are lifted, and household and business expenditure is unleashed. GDP is currently expected to reach pre-pandemic levels by mid-2022.

GDP is forecast to grow by 4% in 2021, accelerate to 7.3% growth in 2022, before settling down to 1.7% in 2023 and 1.6% and 1.7% in 2024 and 2025.

Unemployment is expected to peak at 6.5% in Q4 this year (that's 2.2 million people but a considerable and welcome downward revision from previous forecasts) before reducing to 4.4% in Q4 2024.

The future path of the pandemic, effectiveness of the vaccines and people's compliance with public health restrictions remain critical influencers of future economic growth, as will lingering costs (such as annual revaccinations and continued test and trace activities), public transport adoption, lost education and hospital backlogs.

Currently interest rates (0.1%) are almost as low as they can get. Pressure on public finances will be even more acute if interest rates start to rise.

Conclusion

The pandemic resurgence and third lockdown has been economically damaging but an accelerated vaccination programme and subsequent speedy opening of the economy will facilitate a faster economic recovery.

The Budget has been designed to target areas of rescue, recovery and repair.

Downside risks could come from an evolving and lingering pandemic, legacy costs incurred as a result of covid and its impact, and future increases to interest rates.

Downloads Sexual Harassment – 'Preventative Duty’

Sexual Harassment – 'Preventative Duty’

25 November 2024

The Worker Protection Act 2023 (Amendment of the Equality Act 2010), is UK legislation designed to enhance protections against workplace sexual harassment.

INTERGRAF OPENS APPLICATIONS FOR THE 2025 YOUNG TALENT AWARD

INTERGRAF OPENS APPLICATIONS FOR THE 2025 YOUNG TALENT AWARD

4 December 2024

Intergraf is pleased to announce that applications are now open for the 2025 Young Talent Award, an initiative designed to inspire and shape the future of the print industry. This year, the Award invites young talent to explore how print companies can effectively attract and engage younger generations to pursue careers in the print industry.