17 May 2021

Northern Ireland PMI - activity returns to growth in April

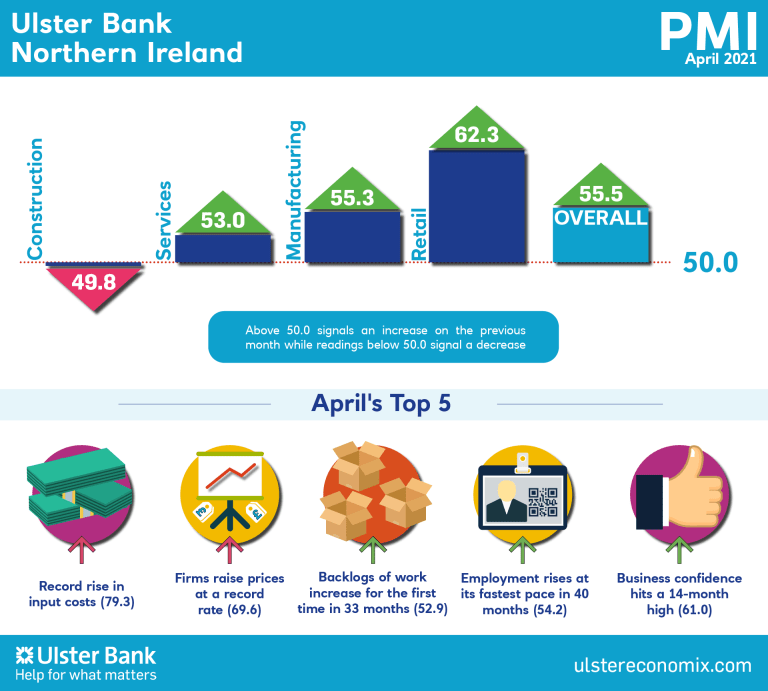

The latest Ulster Bank Northern Ireland PMI report - produced for Ulster Bank by IHS Markit - signalled a return to growth in output at the start of the second quarter, supported by a renewed expansion of new orders. In response, firms upped their rate of job creation. That said, rates of input cost and output price inflation accelerated again.

Commenting on the latest survey findings, Richard Ramsey, Chief Economist Northern Ireland, Ulster Bank, said:

"The start of the second quarter heralded a significant improvement in local business conditions. Northern Ireland's private sector reported a return to growth in business activity and new orders in April although export orders, as opposed to domestic, posted another sizeable fall. The rebound in business activity, the first rise since September 2020, marked the fastest rate of growth in 33 months. Meanwhile employment increased for the second month running with the pace of job creation hitting a 40-month high.

"The improved business performance in April was broad based with retail, manufacturing and services all reporting an increase in both output and employment. Although services, alongside construction, posted a further contraction in new orders. Nevertheless, services firms did record the strongest rate of job creation of all four sectors with employment rising at its fastest pace since August 2007. Manufacturing firms increased their headcount at the fastest pace in almost 7 years.

"Clearly, local firms have benefited from a notable pick-up in demand. But this improvement is occurring alongside significant supply chain disruption. Adapting to the new NI Protocol is one aspect of the increasing cost of doing business. However, it isn't the only source of disruption. Economies around the world have seen a lengthening in suppliers' delivery times due to the pandemic and worldwide shipping issues such as a shortage of shipping containers. Linked to this, Northern Ireland firms once again reported a record rise in input costs stemming from higher prices for raw materials and fuel coupled with increased shipping costs. In turn, companies are also passing these increased costs onto their customers at a record rate. At a sector level, both retail and construction posted record rates of input cost and output price inflation.

"Signs of disruption are also evident elsewhere. Outstanding business increased in April for the first time since July 2018. A surge in new orders explains part of this, but mounting backlogs are also a sign of the widespread supply chain disruption. Indeed, both manufacturing and construction firms saw their backlogs rise at a record rate, highlighting the extent of the issue.

"Supply chain disruption and intense inflationary pressures will be with us for a while. The key question is for how long? Despite these challenges local firms are the most optimistic about business activity in twelve months' time than they have been since the pandemic began. But whilst increasing activity is one thing, increasing profitability may prove to be much more difficult. This is particularly the case in a tight labour market, something that a range of other surveys have highlighted."

The main findings of the April survey were as follows:

The headline seasonally adjusted Business Activity Index posted 55.5 in April, up from 49.7 in March and above the 50.0 no-change mark for the first time in seven months. The reading signalled a marked increase in activity, with panellists reporting improved demand and signs of recovery as COVID-19 restrictions are eased. A similar picture was seen with regards to new orders, which increased for the first time since July last year as customers prepared for the easing of restrictions. New export business continued to fall, however, as Brexit and the COVID-19 pandemic continued to affect efforts to secure exports.

Business confidence strengthened to a 14-month high in April, while the rate of job creation quickened to the fastest since December 2017. Increased capacity wasn't sufficient to prevent a rise in backlogs of work, however, as new order growth tested capacity. Both input costs and output prices rose at series-record rates. Respondents linked higher input costs to greater prices for raw materials, shipping, energy and fuel. Meanwhile, suppliers' delivery times lengthened considerably again, with panellists often linking this to Brexit.

Downloads

Packaging and labels vital to the strategic future of print

Packaging and labels vital to the strategic future of print

7 October 2024

Smithers forecasts +3.6% CAGR for $504.9 billion packaging print market in wake of Drupa 2024

UK Printing - Sector Performance 1995-2023

UK Printing - Sector Performance 1995-2023

7 October 2024

We have produced an analysis of data from the Office for National Statistics providing a detailed product sector breakdown for UK manufacturer sales of printed products.