6 October 2021

Sustainability and Covid reshaping future outlook for printed labels

The drive towards greater sustainability is a trend that cuts across all end use markets. Consumers are increasingly expecting packaging, particularly plastic packaging, to be recyclable and there is a drive from all players in the packaging supply chain to ensure that materials are optimised to facilitate the recycling process. According to a new report from Smithers, The Future of Printed Labels to 2026, the use of pressure sensitive labels and sleeves is increasing, with the traditional wet glue label falling out of favour in most regions. Pressure sensitive labels are easy to apply and are adaptable to a wide range of packaging shapes and types.

The printed label market in 2021 is valued at $41.75 million with a volume of 1.21 billion A4 equivalents. The market grew by 4.3% CAGR in volume and by 3.7% in value between 2016 and 2019, however, the market contracted in 2020 because of the Covid-19 pandemic that had a recessionary effect across all world economies. This led to the market falling in 2020 by 1.1% in volume and 0.8% in value compared to the previous year. The printed labels market is expected to recover swiftly, with a return to pre-pandemic levels of activity projected to take place during 2021, leading to 6.6% growth by volume and 5.8% by value compared to 2020. Ongoing growth is expected from 2020 onwards at a slightly subdued rate compared to the early days of the review period with 4.0% CAGR by volume and 2.9% CAGR in value terms forecast for the five years to 2026.

Impact of COVID-19

Any part of the print industry associated with graphic arts, advertising and event marketing has been severely impacted by the Covid-19 pandemic, whereas package printing has been affected to a lesser degree. In the case of those parts of the packaging business involved in food, beverage, and pharmaceutical markets, print volume has seen a boost of volume, particularly in the early days of the pandemic when food retailers were faced with unprecedented demand.

During the pandemic, demand for printed labels in many countries went through a cycle of strong demand from consumers, de-stocking, and subsequent re-establishment of the retail pipeline with this cycle repeated with decreasing magnitude for each successive wave of infection.

Leading types of labels

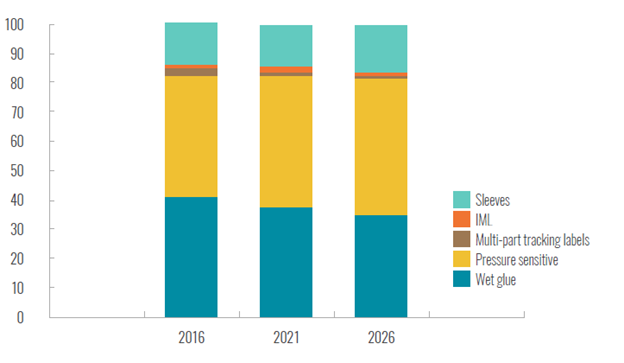

Pressure sensitive labels have the largest market share in 2021 with consumption in 2021 of 538.6 billion A4 equivalents valued at $24.9 billion. Pressure sensitive labels accounts for 44.6% of the volume and 55.3% of the value and use of this label type is increasing throughout the review period and growth is forecast at 5.2% CAGR by volume and 4.0% by value between 2021 and 2026. The second most used label type are wet glue labels which represent 37.5% of the volume and 19.0% of the value in 2021 with demand of 452.9 billion A4 equivalents worth $7.9 billion. Wet glue labels are forecast to grow by 2.3% in volume and 0.8% in value between 2021 and 2026, but are being slowly substituted by pressure sensitive labels. Printed sleeves will also increase their market share.

Printed label format market shares by volume (%); 2016, 2021, 2026

(NOTE: IML is In-Mould Labelling.)

Label print and narrow-web presses continues to be a focus for many print OEMs, and has proven pivotal to the wider market penetration of digital (inkjet and toner) platforms. The majority of labels are still run on analogue presses, flexo accounts for 37.0% of output in 2021, offset litho represents 23.2%, and gravure adds another 13.8% – digital systems are only 9.0% of the market by volume.

By value the proposition for digital is more compelling, combined these represent 28.2% of the market, or $11.79 billion, in 2021. As this segment develops over 2021-2026, inkjet will become the preferred option with output growing at 13.1% year-on-year; while electrophotography falls back to a 5.3% CAGR.

Beyond the adoption of digital print there are several compelling market trends that will be central to future success for narrow-web press manufacturers, ink suppliers, and print service providers:

- Improving the recyclability of labels and release liners is a major trend, supported by virtually all consumer brands and now enshrined in corporate sustainability targets. This will see more label collection schemes, easy-to-remove label formats, and the need to print on label stocks that are themselves constituted from recycled materials or biopolymer films

- A similar impetus will call for more use of lighter weight labels, including much wider use of linerless labels

- Shrink sleeves continue to grow their share of the overall labels market driven by increasing appeal of full-colour, wraparound designs. Through to 2026 new materials will be introduced to replace some existing shrink sleeve substrates, encouraging easy separation

- As demand for luxury goods returns, brands will look for more premium label options, including concepts for e-commerce and omni-channel sales. This will provide a forum for the latest finishing and embellishment technologies: embossing/debossing, spot and high-build varnishes, lamination, hot and cold foiling, and special effect inks

- Online sales will also help make brand protection a more important consideration in label print. Brand owners are eager to switch to labels that carry unique identifier codes – to protect against counterfeiting, give more detailed marketing information, and enable better sorting and recovery at end-of-life – if the price is right

- Productivity improvements will be demanded via the greater automation of narrow-web processes. By the middle of the decade, there will be greater connectivity and integration with MIS systems, while converters will have unified print management platforms linking both analogue and digital print assets.

Market dominance by Asia

The demand for printed labels in Asia has grown consistently, largely due to high growth in demand from China, India, and Japan. As a result, the market share for this region has grown from 2016 to 2021 and is projected to continue to increase up to 2026.

Asia is the largest geographic region for printed labels throughout the review period and in 2021 had a share of 45.4% of global volume and 36.0% of the value, worth $15.0 billion against a volume of 549.2 billion A4 equivalents. The market in Asia is growing throughout the review period, and continued to do so albeit at a modest rate through the crisis of 2020. The market is forecast to grow at 4.5% CAGR in value and 5.7% in volume between 2021 and 2026. North America and Western Europe are the next two largest markets for printed labels and these three regions combined account for 86.0% of the value and 81.1% of the volume in 2021.

Label proliferation and regulation

There is an increasingly complex legislative framework with mandatory inclusion of a range of information including, for example, ingredients of food stuffs, and traceability/authentication elements for many tobacco products. These factors have placed a strain on existing label supply chains that had been set up to cater for economic production of long runs of labels with infrequent design changes. Digital printing technologies form part of the answer to dealing with the increase in demand for short to medium run labels, and digital technology has evolved to the point where it is becoming a viable technology for all print run lengths.

Find out more about The Future of Printed Labels to 2026 on the Smithers website here.

Source: Smithers, www.smithers.com

Downloads WIDE-FORMAT FORECAST FOR PRINTING

WIDE-FORMAT FORECAST FOR PRINTING

8 January 2025

Keypoint Intelligence Forecast Conveys Growth Patterns, Technology Shifts, and Market Opportunities in the Wide Format Industry.

Simpler Recycling Requirements in England

Simpler Recycling Requirements in England

21 January 2025

In order to increase recycling rates the government has introduced measures to simplify workplace recycling in England.