8 April 2022

Smithers report identifies growth segments and technologies for digital printing market

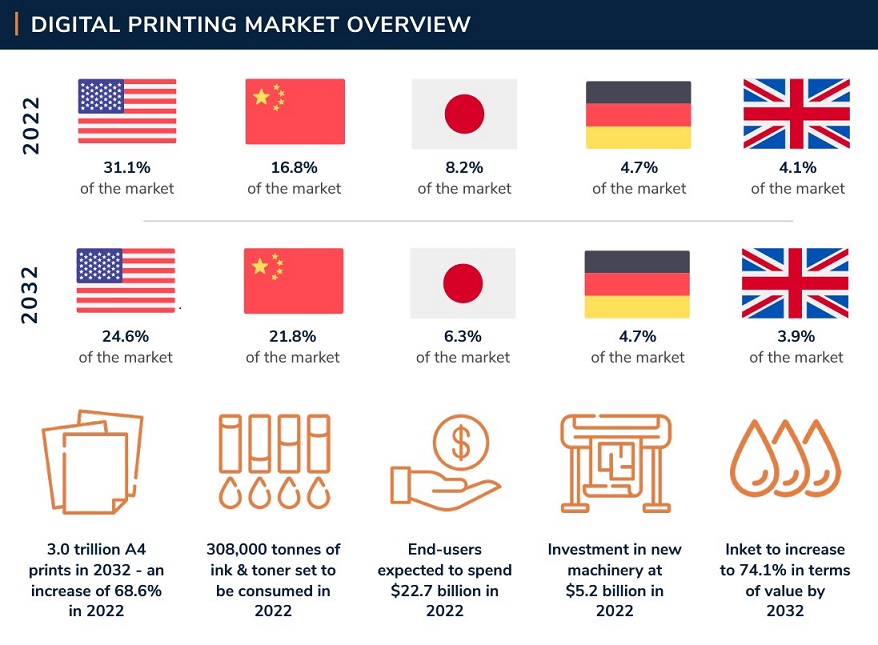

In 2032 digital print will account for almost a quarter of the global value of all print and printed packaging by value, worth $230.5 billion. Inkjet accounted for 61.4% of digital print value with 62.4% of volume in 2022. This will increase to 74.1% of value and 77.5% of volume in 2032.

The Future of Digital Printing to 2032 provides a detailed, long-term assessment of global digital printing. Digital print markets will develop inside the broader print market, which is shifting towards an increasingly digitalised world. Print markets depend on end-user preferences that are subject to the wider economic situation as well as specific trends and drivers.

Technology developments are having a major impact on the prospects for digital printing: in digital print machines as well as in workflow and finishing systems. Inkjet and electrophotographic equipment developers will continue to invest in the technology along with ink and toner manufacturers and substrate suppliers.

Exclusive content

- The impact of major trends and drivers - such as sustainability, retail and supply chain changes - shaping the future of digital print over the next ten years

- Print markets are driven by the latest technology developments. As a part of mixed-channel campaigns, print offerings are increasingly personalised for high spend consumers, which will boost digital print

- Big Data and improved analytics are providing more marketing insight into consumer preferences.

What will you discover?

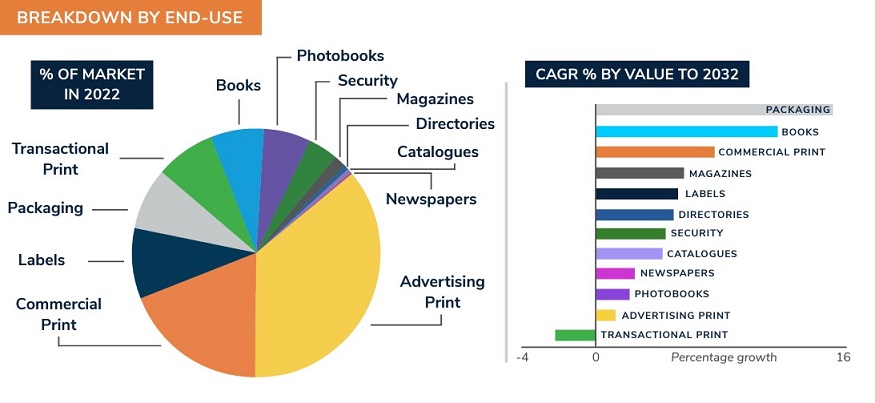

- Most segments of digital print will see rises to 2032 except for transactional printing which declines along with direct mail, business forms and ID

- Packaging will see the biggest change, with digital print gaining traction in corrugated, cartons, flexible packaging, rigid plastics and metal over the period

- There will be more local production for print and packaging, and less reliance on single source just-in-time supply with back up and agility to allow quick response to changing market conditions.

The experience of the Covid-19 pandemic has emphasised the advantage of the versatility of digital print to multiple segments, and its market continues to grow. Exclusive data from the brand new Smithers study - The Future of Digital Printing to 2032 shows that in 2022 this market will be worth $136.7 billion. Demand for these technologies will remain strong with value increasing at a 5.7% compound annual growth rate (CAGR) to 2027, then at 5.0% for 2027-2032; yielding a market value of $230.5 billion in 2032.

Simultaneously extra revenues will flow from sales of inks, toners, new equipment sales, and post-purchase support services. Combined these will be worth $30.7 billion in 2022 and increase to $46.1 billion to in 2032.

Print volumes on digital will rise over the same period from 1.66 trillion A4 prints (2022) to 2.91 trillion (2032), equivalent to 4.7% CAGR.

As analogue print continues to face down some fundamental challenges, the post-Covid landscape will actively favour digital, as run lengths decrease further, print ordering moves online, and customisation and personalisation become more common place.

Simultaneously digital print OEMs will reap the benefits from R&D that improves the print quality and versatility of their machines. Over the ten year period Smithers forecasts that:

- A market for digital cut sheet and web presses will blossom, via the addition of more in-line finishing and higher throughput machines - ultimately able to print more that 20 million A4 prints per month

- Colour gamuts will increase, with fifth or sixth colour stations offering print embellishment options, such as metallic print or spot varnishes, as standard

- Inkjet resolution will see a major improvement with the market poised to welcoming 3,000dpi printheads that can run at 300m/min by 2032

- Sustainability concerns will see aqueous solutions gradually replace solvent-based inks; with pigment-based formulations replacing dye-based inks, initially in graphics and packaging, accompanied by a fall in costs

- The sector will also benefit from wider availability of paper and board substrates optimised for digital production, new inks and surface coatings will allow inkjet to match the quality of offset with only a minor premium.

Such innovations will help inkjet further displace toner as the preferred digital platform. Toner presses will become more restricted in their core segments - commercial print, advertising, labels and photobooks - while seeing some growth in high-end folding cartons and flexible packaging. In the short term, the toner segment will be buoyed by the introduction of HP Indigo's multi-engine LEPx technology, however.

The most lucrative print market for digital will be in packaging, commercial print, and book printing. In packaging the proliferation of digital, with dedicated presses selling into corrugated and folding cartons, will be supplemented by greater use of narrow-web presses to print flexible packaging. This will be the fastest growing of all segments, more than quadrupling between 2022 and 2032. Growth will be slower in labels, a segment that has pioneered digital use, and consequently has achieved a degree of maturity.

In commercial work the market will benefit from the arrival of format sheetfed machines that are now routinely used alongside offset litho or smaller format digital presses, with digital finishing and embellishment systems adding value.

In book print, integration with online ordering and the capacity to produce shorter runs to order will make this the second fastest growing application through to 2032. In this segment inkjet will increasingly dominate, due to its superior economics when single-pass web machines are linked to suitable finishing lines, printing colour output across a wide range of standard book substrates - delivering superior results on standard offset paper grades, and at faster speeds. There will be new revenue as sheetfed inkjet is adopted more widely to print book jackets and covers.

Not all digital print segments will grow, with electrophotography print seeing the worst impact. This is not linked to any distinct problem with the technology itself, but rather reflects overall declines in use of transaction mail and advertising print, and only sluggish growth in newspapers, photobooks and security applications over the next decade.

The technology and market outlook for these technologies over the next ten years is expertly and critically examined in The Future of Digital Printing to 2032 from Smithers.

The historic, current and future market (value and volume) for both inkjet and electrophotography is quantified and presented in over 150 data tables and figures. This segments the market further across 14 leading end-use applications, and over 30 leading national and world regions to deliver an unparalleled level of detail. This is further supported by data on ink, toner, and equipment sales; and new data on the future markets for spare parts and service/support revenue through to 2032.

Source: Smithers, www.smithers.com

Downloads Growth in output and orders ramped up in Q3 alongside boost in confidence - stronger growth forecast to hold in Q4

Growth in output and orders ramped up in Q3 alongside boost in confidence - stronger growth forecast to hold in Q4

7 November 2024

The pace of growth in output and orders picked up in Q3 as the UK's printing and printed packaging industry benefitted from a previously delayed boost in confidence materialising in the third quarter of 2024.

Pay Review and Wage Benchmarking - NEW UPDATE

Pay Review and Wage Benchmarking - NEW UPDATE

11 November 2024

We have collated data from multiple sources that should be useful for BPIF members that are approaching internal pay reviews, and/or are having a closer look at their pay and benefits structure.