16 November 2022

BPIF Energy Costs Survey 2022 - summary report

When it became apparent that rapid and extreme energy cost increase were going to have a significant impact on many companies in the UK printing and printed packaging industry the BPIF designed a survey to gather information from companies. This information has been used to help inform and add weight to our regular discussions with Government and other industry stakeholders on the issue of energy price increases., the effect of these on printing and printed packaging companies, and the wider impact on the future of the industry. Here we provide a summary of the main findings from this research.

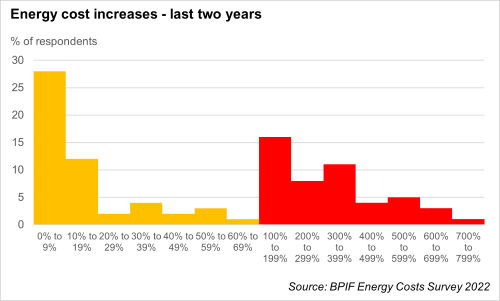

Incurred increases over the last two years

28% in the 0% to 9% category - BUT 48% have incurred increases greater than 100% (24% greater than 300%).

Contract

44% have less than a year to run in the current contract, 35% have 1 to 3 years left.

Surcharges

63% have incurred energy surcharges on their purchases.

Paper, board, plastic film, ink, varnish, glue, chemicals, plates, laundry, and transport services have all attracted energy surcharges.

Obtaining energy supply quotes

52% have struggled to get quotes from alternative suppliers.

Security deposits or cash bond provision is an issue. Uncertainty heightened prior to Government announcement on support. Short-term window (one hour) for quote acceptance seems unreasonable for such a major cost decision. Energy suppliers refusing to take on new business in an extremely volatile marked - many examples of quote requests being refused, or extremely high quotes offered.

Expected increases in next two years

40% in the 0% to 9% category so far - BUT 49% expect increases greater than 100% (46% in the 100% to 600% ranges).

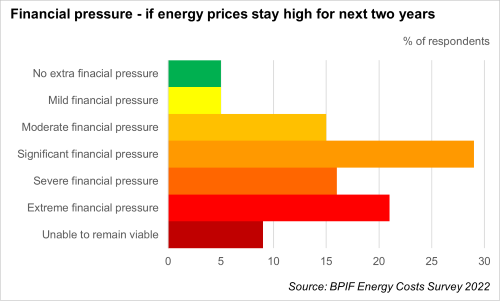

Financial pressure

75% of companies expect to be under at least significant financial pressure if energy prices remain high for the next two years. 37% expect that pressure to be severe or extreme and 9% believe that their business will be unable to remain viable.

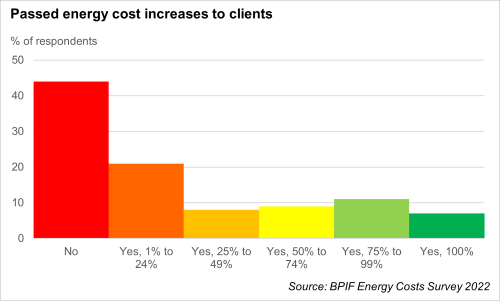

Passed costs on

43% have not passed any incurred energy costs on to their clients. 27% have passed on at least half of the incurred energy cost increases.

Surcharge

32% have no intention to impose an energy surcharge; 9% have and 19% are currently considering it. 40% might consider an energy surcharge in the future.

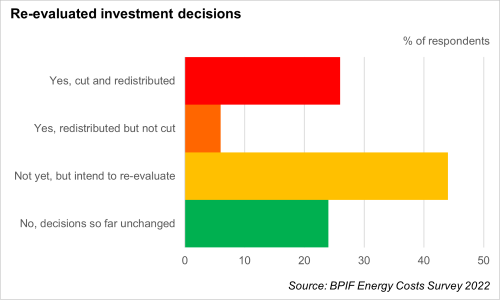

Investment

26% have already cut and redistributed investment, 44% intend to re-evaluate their investment decisions.

Comments on actions

Significant moves towards installing solar, LED lights, and introducing other energy efficiency initiatives such as voltage optimisation.

Reducing use of energy intensive processes - such as UV lamps. Reducing the length of time heating is on and lowering the temperature. More efficient compressed air systems, heating systems, and better insulation.

Curtailed production and mothballing proportion of factories and consolidating offices. Changing shift patterns, reducing headcount, re-financing of assets, closing down.

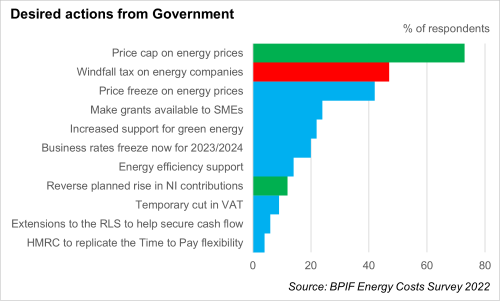

Top desired actions from Government are:

- Price cap on energy prices to business - 73%

- Windfall tax on energy companies - 47%

- Enforce a price freeze on energy prices - 42%

- Make grants available to SMEs - 24%

- Increased support for green energy - 22%

- Freeze on business rates - 20%

About this survey

The BPIF Energy Costs Survey 2022 collected response from 102 companies in the printing and printed packaging industry during September and October. Responses predominantly came from BPIF members, but some Picon and IPIA members were also included.

Downloads Growth in output and orders ramped up in Q3 alongside boost in confidence - stronger growth forecast to hold in Q4

Growth in output and orders ramped up in Q3 alongside boost in confidence - stronger growth forecast to hold in Q4

7 November 2024

The pace of growth in output and orders picked up in Q3 as the UK's printing and printed packaging industry benefitted from a previously delayed boost in confidence materialising in the third quarter of 2024.

Pay Review and Wage Benchmarking - NEW UPDATE

Pay Review and Wage Benchmarking - NEW UPDATE

11 November 2024

We have collated data from multiple sources that should be useful for BPIF members that are approaching internal pay reviews, and/or are having a closer look at their pay and benefits structure.