3 July 2023

Northern Ireland - Economic Update June 2023

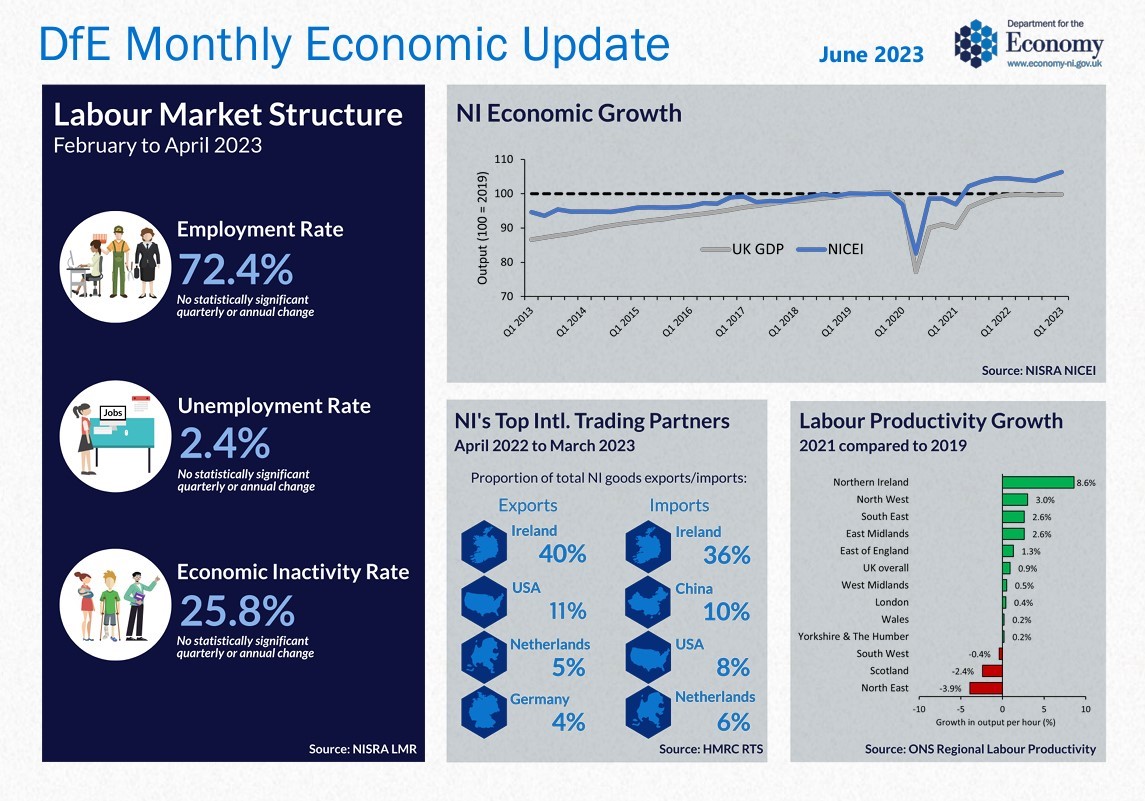

NI economic output increased by 1.2% in the first quarter of 2023, reaching a record high with output now 6.3% above pre-pandemic levels. UK GDP increased by 0.1% over the quarter but remains 0.5% below its pre-pandemic level (NISRA NICEI).

Contrasting fortunes were experienced by NI's construction, production, retail and services sectors in Q1 2023 (Figure 1) with production output declining by 0.4%, continuing the gradual downward trend of the preceding three quarters (NISRA IOP). Services output reached a new series high, increasing by 2.2% over the quarter to a level 7.4% above the pre-pandemic level (NISRA IOS). Retail output increased by 3.3% over the quarter but remained below pre-pandemic levels (NISRA RSI). Construction output remained unchanged over the quarter (NISRA Construction Output).

Invest NI published its 2022 KPIs, showing an increase in sales and employment across all Invest NI supported sectors, with both metrics being led by Advanced Engineering & Manufacturing.

Analysis from UUEPC indicated that there was a persistent gap in business churn (measured as the business birth rate plus the death rate) between NI and the UK over the past decade with a gap of 5.2 percentage points (pps) in 2021, indicating that the local economy was less dynamic than its national counterpart. The IDBR (NISRA) reported that in NI in 2023, 79,235 businesses were VAT and/or PAYE registered, a 0.4% increase since March 2022. Of note, the number of production firms fell over the year to March 2023 by 1.4%, which is the first time this industry has declined since 2013.

The Ulster Bank PMI indicated that despite a slowing of growth in May, business activity increased for the 4th consecutive month. Increased new orders for services and retail supported business confidence, with firms optimistic that output will rise over the year. Weakening international demand was reported. The rate of input and output cost inflation eased, with the pace of inflation in NI the weakest across all UK regions.

Between 2019 and 2021, NI labour productivity grew by 8.6%, an increase that was the largest of any UK region and one that saw NI improve its relative productivity ranking amongst UK regions (from 11th to 7th). However, labour productivity in NI remains lower than the UK average (-10.6% in 2021) (ONS Regional Labour Productivity).

The NI labour market was in a relatively stable position in May 2023 with payrolled employee numbers unchanged over the month while median monthly pay decreased marginally (-£4). There were 140 confirmed redundancies - more than double the 2022 monthly average. In the three months ending April 2023, the unemployment rate reached parity with the pre-pandemic position while the economic inactivity rate was 0.1pps below the pre-pandemic position (NISRA LMR). Meanwhile, the number of employee jobs increased for the 8th consecutive quarter in Q1 2023, reaching a series high (NISRA QES).

The value of every UK nation's international trade in goods increased in the 2022-23 financial year, with NI exports and imports increasing by around £1.5bn (18%) and £1.4bn (17%) respectively compared to the previous year. Ireland (IE) - NI's main international trading partner - accounted for nearly two-fifths of the increase in exports and a third of that of imports. In Q1 2023, the value of EU exports exceeded the value of EU imports for the first time since the Q1 2021 (ONS Regional Trade in Goods).

NI-IE cross-border traffic has surpassed pre-pandemic levels, with the latest (May 2023) 12-month average of around 47.5mn vehicles representing a series high. This increase in traffic has been predominately driven by light goods vehicle traffic of which the 12-month average has increased by 15% since February 2020 (Figure 2) (NISRA Traffic Counts at NI-IE Border). With the Pandemic further fuelling the shift from physical to online retail, the increase in LGV traffic may be attributable to changing retail preferences.

In the year to March 2023, the proportion of electricity consumed from renewable sources in NI was 48.5% - an increase of 4.6pps on the previous 12 month period (DfE Electricity and Renewable Generation). Figure 3 shows NI's progress towards the 2030 target set by the Climate Change Act.

The CPI (ONS) rose by 8.7% in the twelve months to May 2023, unchanged since April, while Core CPI (excluding energy, food, alcohol and tobacco) rose by 7.1% in the same period, up from 6.8% in April, and the highest rate since March 1992. UK inflation has remained "stickier", with annual inflation rates easing at a quicker rate in the US and the rest of Europe. On 22nd June 2023, the Bank of England Monetary Policy Committee increased Bank Rate to 5.0%, the 13th consecutive increase since December 2021.

Source: Department for the Economy, Monthly Economic Update - June 2023

Download the full summary from the Department for the economy below - it contains further information, infographics, charts and links to further data from quoted sources.

Downloads INTERGRAF OPENS APPLICATIONS FOR THE 2025 YOUNG TALENT AWARD

INTERGRAF OPENS APPLICATIONS FOR THE 2025 YOUNG TALENT AWARD

4 December 2024

Intergraf is pleased to announce that applications are now open for the 2025 Young Talent Award, an initiative designed to inspire and shape the future of the print industry. This year, the Award invites young talent to explore how print companies can effectively attract and engage younger generations to pursue careers in the print industry.

Intergraf Economic News (Paper Prices) - December 2024

Intergraf Economic News (Paper Prices) - December 2024

5 December 2024

Access the latest edition of the Economic Newsletter for the European Printing Industry for data on paper consumption, and pricing data for pulp, paper, and recovered paper.