17 January 2024

Northern Ireland - stuck in second gear

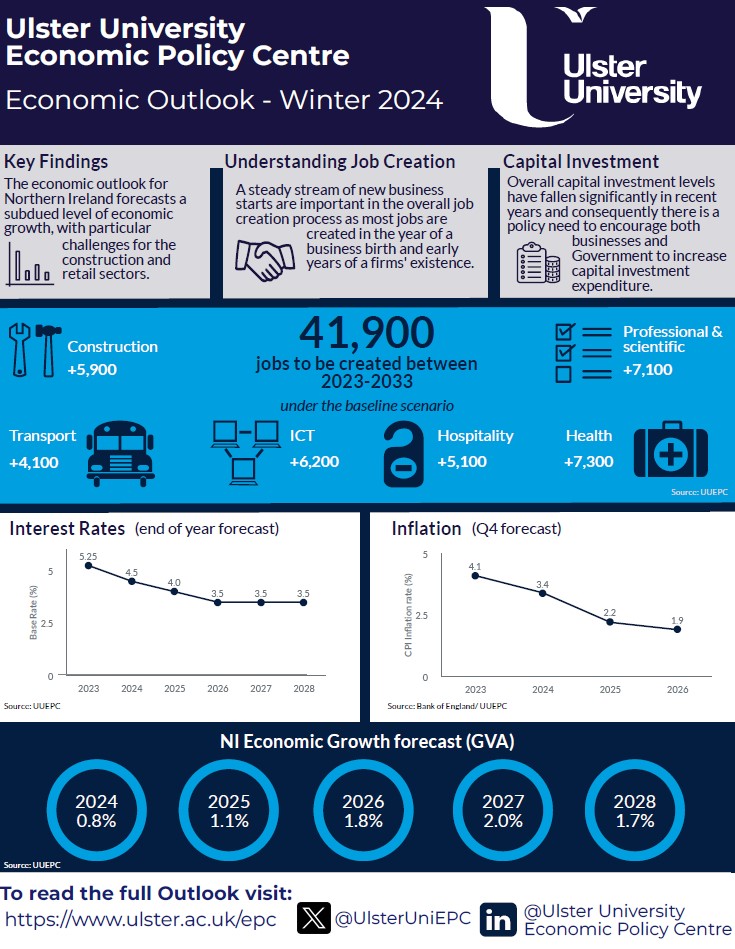

UUEPC have released their economic forecasts for 2024 and beyond suggesting subdued level of economic growth. The forecasted growth rate for Northern Ireland in 2024 is 0.8%, representing a slight decrease of 0.1% compared to last year. Low-level growth predictions are a similar outlook for the UK at 0.7%. This means that there remains the risk of a technical recession.

Despite low growth, UUEPC forecast an additional 41,900 jobs could be created in Northern Ireland by 2033 in a baseline scenario, in an upper scenario 77,600 jobs could be created. Jobs in Health and Social Work and the Professional and Scientific sectors are estimated to experience the largest increase in jobs.

The current cycle of monetary tightening appears to have peaked, but there remains a significant divergence in expectations about the pace of interest rate reductions between the Bank of England and the wider financial markets. The markets are now anticipating base rates in the region of 4.0% to 4.25% by years end, but Andrew Bailey, the Bank of England Governor, is sticking to his "higher for longer" mantra, implying perhaps only two quarter-point reductions this year. For our part, the UUEPC is striking a middle ground with three quarter-point reductions over the course of the year.

Of course all this is data dependent. It takes approximately 18-24 months for the full impact of interest rate rises to fully transfer through to the economy and therefore many of the more recent rises have still to take effect. As a result, with an economy already in very low growth mode, the risk of a technical recession remains high, but in that scenario one would expect the Bank to reduce interest rates more quickly.

Either way, it is essential that both the UK Government (Conservative or Labour) and any returning Executive focus on economic policies to take us out of this current low growth gear.

Source: UUEPC Outlook - Winter 2024

Geopolitical concerns are likey to remain elevated with uncertainties regarding US and UK elections, conflict in the Middle East and Ukraine, and NI's continued political limbo but employment growth remains positive and there has been some indication of stronger growth at the end of 2023. Hopes are building that the Bank of England and Government will indeed be able to navigate a soft landing for the economy. Ulster University economists are calling for more productivty growth, driven not just by labour market growth but increased capital investment.

Download and read the full Outlook below.

Downloads POSITIVE Q4 OUTPUT AND ORDERS GROWTH IN-LINE WITH FORECAST – BUT A NOSEDIVE IN CONFIDENCE HAS DEPRESSED EXPECTATIONS FOR Q1

POSITIVE Q4 OUTPUT AND ORDERS GROWTH IN-LINE WITH FORECAST – BUT A NOSEDIVE IN CONFIDENCE HAS DEPRESSED EXPECTATIONS FOR Q1

6 February 2025

Output and orders in Q4 more-or-less performed as forecast as the UK's printing and printed packaging industry continued its path of steady, but subdued, growth in 2024.

New research charts the transition from offset to digital print

New research charts the transition from offset to digital print

27 February 2025

In The Future of Digital vs. Offset Printing to 2029 Smithers examines how competing digital and offset printing technologies contend for market share. The new report quantifies the market by print process, end-use application, and region.