22 February 2024

Slight recovery of output and orders falls short of expectations in Q4 - confidence concerns mount in 2024

Performance in the UK's printing and printed packaging industry did improve in Q4, as far as output and orders are concerned. However, it didn't come close to what would historically be considered the seasonal norm, nor quite match the subdued expectations for Q4. Output was expected to return to growth in Q4, and that did indeed happen - on balance. Unfortunately, a few more companies than expected experienced a downturn, and that limited overall growth.

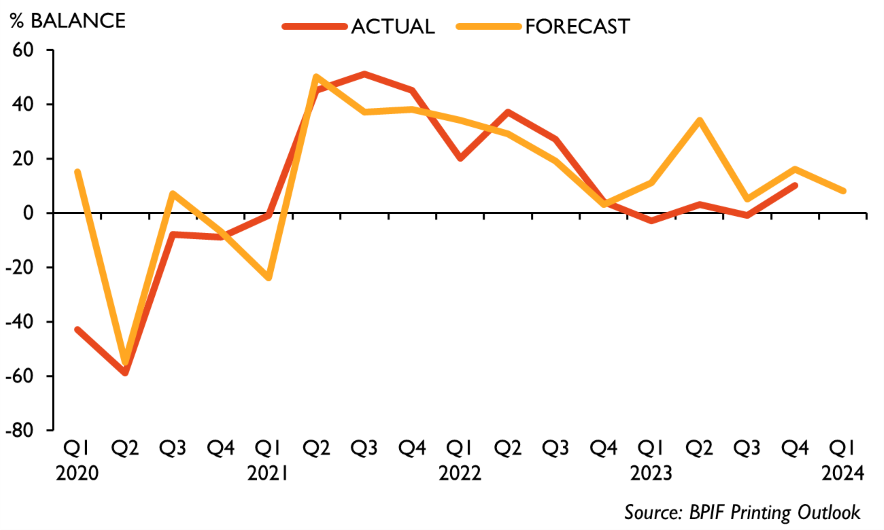

VOLUME OF OUTPUT - SOME IMPROVEMENT IN Q4, LOW GROWTH TO HOLD IN Q1

The output balance of +10 was below the forecast of +16 for Q4. A balance of +8 is forecast for Q1.

Previously, a fragile economy, lingering concerns over inflation levels, for both consumers and businesses, and the possibility of further interest rate increases; were restricting growth. These concerns have now diminished, inflation is expected to hit its 2% some time in Q2, market expectations are that interest rates will fall to 3.25% at the end of next year, and UK economic growth is expected to pick-up - albeit very gradually. However, caution over costs remain and, with rising tensions in the Middle East, and forthcoming elections in the US and UK, the geopolitical situation remains uncertain.

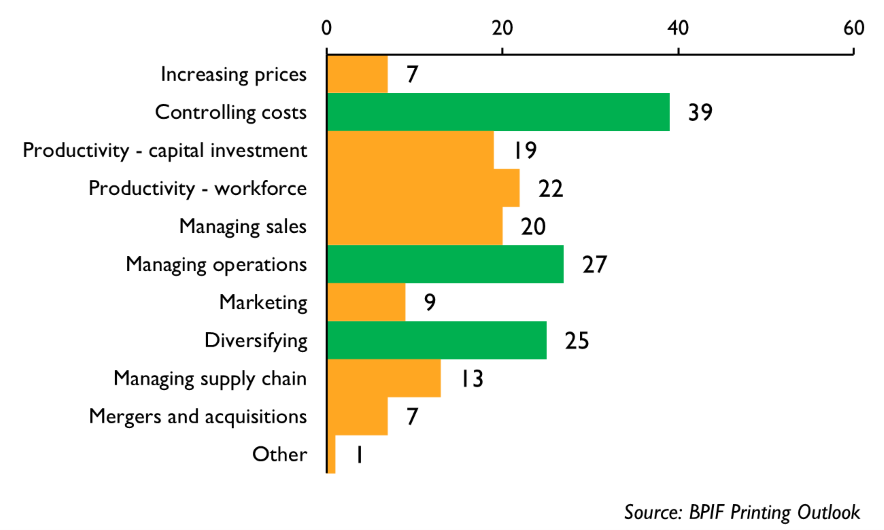

Printers continue to concentrate on controlling costs, increasing productivity, and be largely cautious regarding investment. Some cost pressures have eased, and whilst energy is expected to ease further, there is mounting concern over future paper and board prices, and labour costs - which will come under additional stress when national minimum wage increases add pressure to maintain wage differentials in the workforce.

PLANS TO INCREASE PROFITABILITY - % OF RESPONDENTS SELECTING

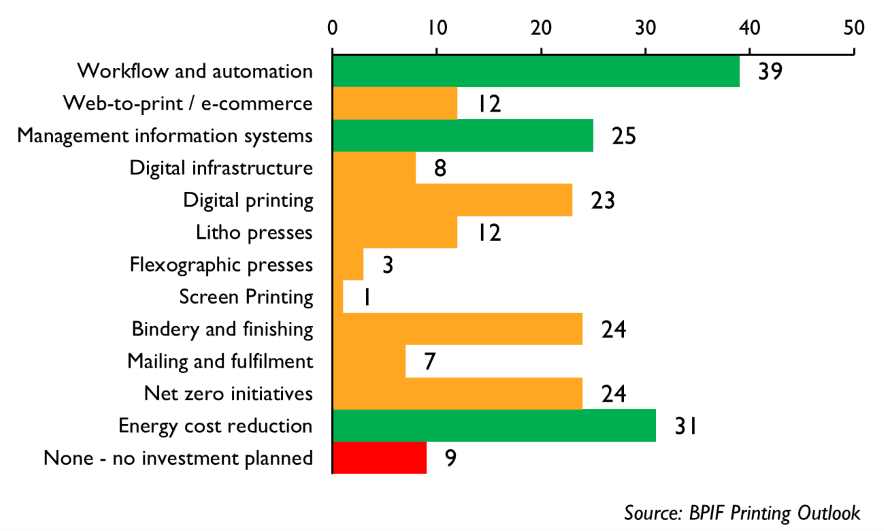

However, capacity utilisation has improved in each for the last two quarters, some significant cost pressures have levelled out, a majority of companies seem to be in a decent financial position with positive investment intentions - and a particular focus on innovation, efficiency and sustainability related improvements.

TOP INVESTMENT TARGETS - % OF RESPONDENTS SELECTING

The BPIF Printing Outlook Q1 2024 report features sections on industry turnover, business concerns, investment, costs, pay reviews, paper and board, and much more.

Kyle Jardine, BPIF Economist, said:

"This edition contains a section focused on Investment, and it is fair to say that investment intentions for the year ahead are a little mixed. Expenditure on plant and machinery looks set to remain subdued this year, though marginally stronger than last year. Product and process innovation investment is expected to be stronger. Investment in training and retraining is expected to show continued growth, just not quite as positive as in the last two years. However, the most rapidly increasing area of investment is for sustainability, net zero and energy efficiency initiatives.

"Further comments from companies help explain why there are some polarised investment capabilities. Many of the companies that were forced to take Government backed loans, to survive the Covid-affected years, are more focused on repaying that debt than ramping up their investment levels just yet. Others are carefully waiting for an improvement in industry and economic confidence before committing to major investments. However, some respondents have been able to proceed earlier than expected with their investments, on the back of positive demand, and Government initiatives to encourage business investment."

Charles Jarrold, BPIF Chief Executive, said:

"Quarter 4 did see a seasonal uplift in activity, as we'd expect, but it's also clear that business was tougher than usual. The slightly lower than usual uplift meant that competitive pressures were stronger than ever, and companies were also experiencing cost pressures notably on the staffing side.

It's also an ongoing and long-standing concern to again see the feedback on bad debts and late payment., with both having increased in 2023. It is also pretty appalling to see a significant minority of companies have been forced on to payment terms in excess of 120 days. We have raised the need to address this robustly in legislation repeatedly with Government, clearly we need to continue push for real action, and Printing Outlook provides evidence to help us do that. It is concerning that some respondents are being squeezed into a profit and cash flow crisis, though thankfully this is currently a small minority of companies.

"Economic growth in 2024 is expected to be modest but should at least provide a marginally better platform for the industry to continue the recovery that started in Q4 last year. And with drupa to come later in the year, we can expect a boost to industry, and I hope, exciting innovations and products for the future."

Duncan Smith, Country Director, Production, Canon UK & Ireland, and sponsors of the Printing Outlook report, said:

"We remain committed and will continue our partnership with the BPIF through our sponsorship of its Printing Outlook Report - delivering the latest trends to the print industry each quarter. The insights shared in 2023 were very useful and helped to shape the direction of businesses in the print sector.

We'd like to thank the BPIF and its members for their continuous hard work and hope that we can further build on our work together, throughout 2024."

Summary of key findings:

- Performance in the UK's printing and printed packaging industry did improve in Q4, as far as output and orders are concerned. However, it didn't come close to what would historically be considered the seasonal norm, nor quite match the subdued expectations for Q4.

- Forecasts for Q1 are for further marginal improvements in output growth, though a significant proportion of companies are not expecting to see any change.

- In recent quarters the industry consensus on the general state of trade has not matched that for orders and output. So, whilst orders and output have shown some improvement, confidence in the general state of trade deteriorated in Q4.

- Concern that competitors are pricing below cost has become the new top business concern for printing companies, though the top three are only split by single percentage points.

- More companies decreased, than increased, employment levels in Q4. However, finding and securing adequate labour remains a frequently voiced concern. Despite this, recruitment expectations are improved for Q1.

- Labour costs remain the primary cost concern, whilst other cost levels have either stabilised or subsided slightly.

- A majority of printers were able to hold margins steady in Q4, but margins did come under increased pressure, on balance, as price reductions for many took effect.

- When it comes to company plans to increase profitability in the next twelve months, cost control remains the primary area of focus.

- Just under one-quarter (24%) of respondents reported that they had conducted a pay review in Q4, the resulting average (mean) change in basic pay was 4.4%.

- Decisions around investment have been more challenging in recent years - on the back of Covid, extra debt and higher than preferred interest rates. However, some companies do find themselves to be in stronger position to consider their investments this year; and investments related particularly to sustainability, net zero and energy efficiency initiatives are attracting significantly more attention.

- Almost one-fifth (19%) reported that they were already using Artificial Intelligence (AI), another 16% noted that they are currently researching the use of AI, and 15% that they were interested in exploring AI.

- Following on from 2022, the most noticeable recent changes around access to finance and credit conditions have been an increase in the cost of finance, and an increase in levels of late payment and bad debt.

- The last quarter has seen a fall in natural gas and electricity wholesale prices, bringing much relief to industrial consumers already experiencing, or looking forward to, reductions in bills.

Featured in Printing Outlook this quarter:

- Output and orders - last quarter and forecast for this quarter.

- Business confidence, concerns, and uncertainty levels.

- Turnover - annual and monthly turnover analysis and forecasts.

- Capacity - utilisation and constraints.

- Costs - paper & board, ink, labour, energy, and average cost structure.

- Trend data on employment, prices, costs, margins, profits, cash flow and productivity.

- Profitability benchmarks and plans for improvement.

- Pay Reviews - activity and average % changes.

- International trade - export orders and price trends.

- Investment - key targets.

- Financing and credit conditions - access to finance, late payment, and payment terms

- Consumables - paper consumption and printing ink data.

- Energy - sector update and comment.

Downloads

Packaging and labels vital to the strategic future of print

Packaging and labels vital to the strategic future of print

7 October 2024

Smithers forecasts +3.6% CAGR for $504.9 billion packaging print market in wake of Drupa 2024

UK Printing - Sector Performance 1995-2023

UK Printing - Sector Performance 1995-2023

7 October 2024

We have produced an analysis of data from the Office for National Statistics providing a detailed product sector breakdown for UK manufacturer sales of printed products.