21 March 2024

UK to follow global expansion of inkjet printing

The latest expert analysis from Smithers identifies the potential of the latest generation of inkjet systems to improve profitability across the global print market. Read more about the new report The Future of Inkjet Printing to 2029.

Authored by print expert and consultant Sean Smyth, this brand new research explores:

- How inkjet will continue to challenge and displace analogue processes in multiple print applications

- How the move towards sustainability in packaging will affect the outlook for inkjet printing

- How technology developments will allow printers to innovate and provide services that meet new customer needs and expectations

- How inkjet can profit from the incoming legislation changes which will fundamentally change the packaging industry.

Inkjet is steadily increasing its penetration into the total print and packaging market, and improvements are regularly announced in printheads, inks, print engines, driers with innovation to integrate inkjet into print manufacture, and finishing equipment suppliers.

Data from the new report shows that:

- In 2024 world value of inkjet printing for publications, graphics, packaging & labels will reach $91.3 billion, up from $69.0 billion in 2019.

- Across the same period the volume of material printed in inkjet has increased from 754.1 billion A4 prints to almost 1.18 trillion.

- Future value growth year-on-year is forecast by Smithers at +6.6% for inkjet to 2029; nearly four times faster than growth for other print systems.

- Inkjet printing is a major part of the UK print landscape. Total output in 2024 will be 61.0 billion A4 prints, worth $4.45 billion in 2024.

- The most significant market gains for UK print service providers across 2024-2029 will come in commercial printing, books, and packaging work.

- Growth in graphics will slow to 2029, while the value of inkjet printed packaging will almost double to $916 million, led by the corrugated sector.

- Over the same period inkjet inks sales in the UK are forecast to increase from $547.5 million to $723.2 million.

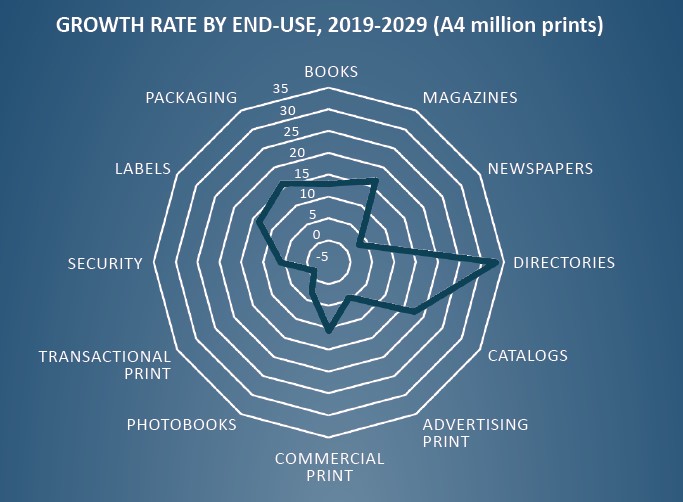

- Worldwide over the next five years, Smithers analysis shows the digital technology will breathe new life into several publication sectors - with books, magazines, directories and catalogues all forecast for double-digit annual growth.

- The largest contemporary market is in short-run advertising work (brochures & pamphlets, direct mail, indoor and exterior displays). This accounts for 49.2% of contemporary demand, but has a low growth outlook as advertising budgets switch away from physical to online channels.

- The fastest growth will be in packaging print at a +14.5% compound annual growth rate (CAGR). This will leverage installations of a new generation of high-productivity inkjet machines for printing on corrugated board (HP PageWide, BHS) and folding cartons (Landa, KBA-Durst, Epson, etc)

- Inkjet has a stronger base in label print, (~10% market share), but has competition from toner and analogue presses. The latest innovations are boosting speeds, with 120m at 1,200dpi now possible. Many OEMs are now looking to extend options on narrow-web inkjet to print short flexible packaging runs.

- B1, B2, and B3 sheetfed inkjet machines are growing in commercial print applications. With very high-quality output these can challenge offset litho print; Smithers forecasts this segment will growth at a +11.7% CAGR, globally .

- Several UK companies have helped pioneer the development of inkjet equipment for functional and industrial applications. Smithers data reveal this segment will continue to grow in value, from $26.4 billion in 2024 to $36.3 billion in 2029.

The Future of Inkjet Printing to 2029 provides a global outlook for the inkjet printing market. Discover how the move towards sustainability in packaging, the latest technology developments and legislative changes will impact inkjet printing to 2029.

With over 270 data tables and figures, combined with expert technical analysis, The Future of Inkjet Printing to 2029 gives unparalleled insight into one of the most existing sectors of print. Data on print output, equipment sales, installed base, and consumables for 2019-29 segmented across 15 end-uses, and over 30 regions and leading national markets.

Smithers are currently offering a 10% pre-publication discount, valid until midnight, 31 March - follow the link below to find out more and purchase the report.

Downloads POSITIVE Q4 OUTPUT AND ORDERS GROWTH IN-LINE WITH FORECAST – BUT A NOSEDIVE IN CONFIDENCE HAS DEPRESSED EXPECTATIONS FOR Q1

POSITIVE Q4 OUTPUT AND ORDERS GROWTH IN-LINE WITH FORECAST – BUT A NOSEDIVE IN CONFIDENCE HAS DEPRESSED EXPECTATIONS FOR Q1

6 February 2025

Output and orders in Q4 more-or-less performed as forecast as the UK's printing and printed packaging industry continued its path of steady, but subdued, growth in 2024.

New research charts the transition from offset to digital print

New research charts the transition from offset to digital print

27 February 2025

In The Future of Digital vs. Offset Printing to 2029 Smithers examines how competing digital and offset printing technologies contend for market share. The new report quantifies the market by print process, end-use application, and region.