23 April 2024

JICMAIL scales up its Response Rate Tracker for 2024, revealing new Direct Mail and Door drop benchmarks from over 2,300 campaigns and thirteen contributing organisations

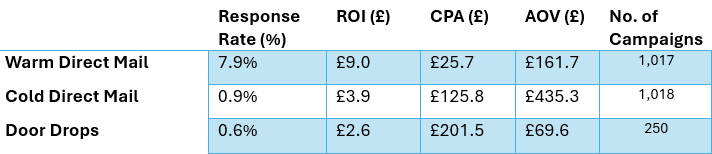

London, 22 April 2024: JICMAIL – The Joint Industry Currency for Mail – has today released the latest results from its Response Rate Tracker to reveal that the average warm Direct Mail campaign has a response rate of 7.9%, cold Direct Mail 0.9% and Door Drops 0.6%.

The JICMAIL Response Rate Tracker 2024 contains aggregated anonymous campaign level data gathered from over 2,300 campaigns by thirteen different organisations spanning sell-side businesses, agencies, data and technology partners. The number of organisations submitting response data, as well as the number of campaigns measured, has more than doubled year on year.

For the first time, the Response Rate Tracker is able to report on key performance metrics for Door Drops, alongside cold and warm Direct Mail.

In addition to Response Rate data, benchmarks are also available for Cost Per Acquisition (CPA), Average Order Value (AOV) and Return on Investment (ROI) metrics.

Benchmarks are available across twenty-two sectors and product categories, including the retail / online retail, mail order, finance, charities, telecoms, travel and medical sectors.

The highest response rates for warm direct mail are found in the medical category (25.9%), while for Cold DM, the highest rates are found in the Retail / Online Retail and Mail Order sectors (1.0%). For Door Drops, the highest response rates were found in Retail / Online Retail (3.0%).

While warm DM has over double the ROI of cold DM (£9.0 vs £3.9) due to higher response rates and 80% lower CPAs, cold DM is a vital channel for customer acquisition. Average Order Value is over x2.5 higher for cold vs warm DM, pointing toward the high value that a new customer obtained via mail can bring to an organisation once the heavy lifting of acquisition is done.

With an average response rate of 0.6% and ROI of £2.6, Door Drops are also a vital mail channel for customer acquisition and are being used to good effect by advertiser sectors ranging from telecoms, retail / online retail, mail order, charities, to gambling, magazine publishing and letting / estate agents.

In addition to the six contributing organisations from 2023 – Ginger Black Analytics, Epsilon, DBS Data, Join The Dots, Sagacity and the Letterbox Consultancy - JICMAIL are delighted that seven new participants have contributed data to the Response Rate Tracker this year: Whistl, PaperPlanes, Conexance Choreograph, PSE Offline Marketing, The Specialist Works, Go Inspire and Herdify.

Response Rate Tracker data is now available to all JICMAIL subscribers through a new interactive dashboard viewable in JICMAIL Discovery – the data portal by which JICMAIL’s community of over 250 accredited organisations access industry-leading mail campaign planning and measurement data.

Key Performance Benchmarks from the Response Rate Tracker 2024:

Ian Gibbs, JICMAIL’s Director of Data Leadership and Learning says “In an economic climate in which performance marketing is struggling to make an impact, it is vital that marketers widen the net and explore all channels available when looking to driving immediate returns from their marketing spend. Having accurate benchmarks by which to set targets, track relative performance, and validate measurement results, are all crucial steps in making the most out of a performance-oriented Direct Mail or Door Drop campaign. I’m delighted that we’ve managed to bring an expanded Response Rate Tracker to the industry to help do just this in 2024.”

Mark Cross, JICMAIL’s Engagement Director commented “Thanks to the great collaboration from our contributing partners, this latest Response Rate Tracker provides a rich suite of response benchmarks across more categories for more campaigns and mail types. Users can now triangulate across JICMAIL data, their own data and these benchmarks to create a great fix on their campaign performance. Delighted too to make the data available as an easy-to-use interactive dashboard in Discovery for all subscribers.”

INTERGRAF OPENS APPLICATIONS FOR THE 2025 YOUNG TALENT AWARD

INTERGRAF OPENS APPLICATIONS FOR THE 2025 YOUNG TALENT AWARD

4 December 2024

Intergraf is pleased to announce that applications are now open for the 2025 Young Talent Award, an initiative designed to inspire and shape the future of the print industry. This year, the Award invites young talent to explore how print companies can effectively attract and engage younger generations to pursue careers in the print industry.

Intergraf Economic News (Paper Prices) - December 2024

Intergraf Economic News (Paper Prices) - December 2024

5 December 2024

Access the latest edition of the Economic Newsletter for the European Printing Industry for data on paper consumption, and pricing data for pulp, paper, and recovered paper.