14 June 2024

Mail response and attention continue on an upward trajectory in Q1 2024

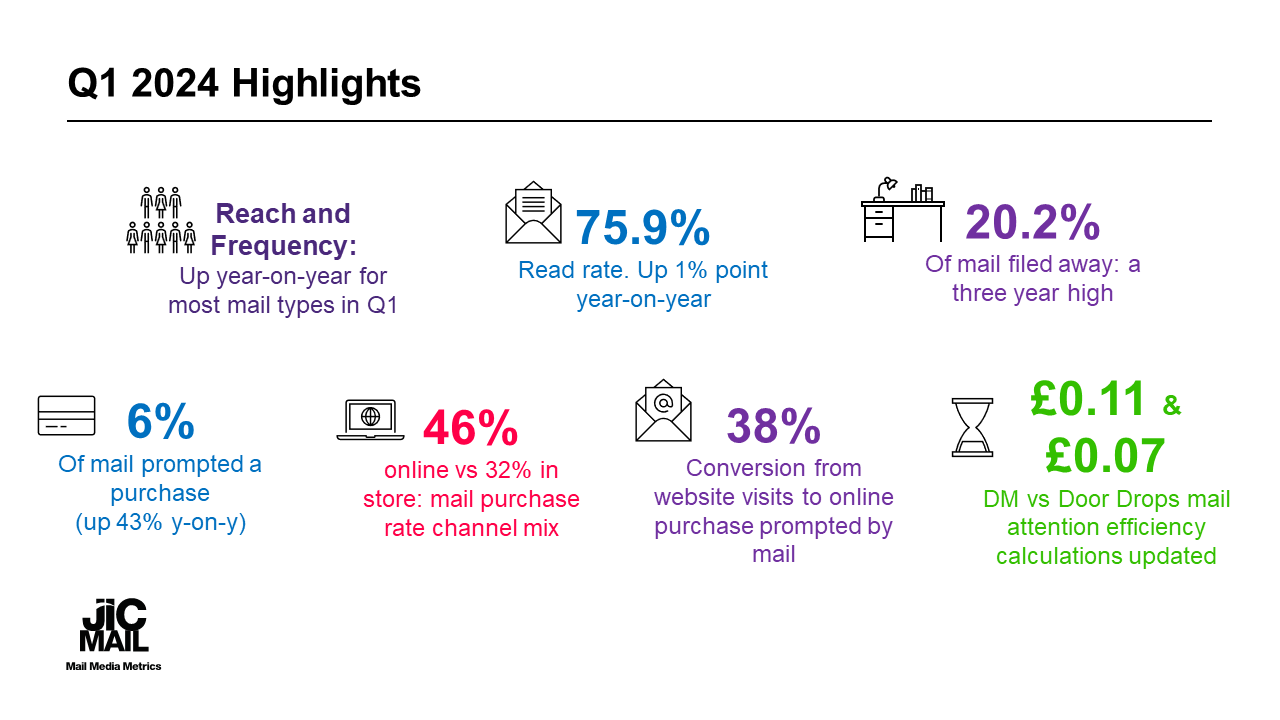

London, 11 June 2024 - The latest quarterly results from JICMAIL reveal that 6% of mail (including Direct Mail, Business Mail, Partially Addressed Mail and Door Drops) prompted a purchase in Q1 2024, while the average amount of time spent with a piece of Direct Mail across 28 days climbed to 134 seconds.

JICMAIL - The Joint Industry Currency for Mail - has revealed that while the UK economy grappled with the recovery from a technical recession, those advertisers who maintained their confidence in the mail channel were rewarded with 43% year on year growth in purchases driven by mail.

- 6% of mail prompted a purchase in Q1 2024 - up from 4.2% in Q1 2023. These purchases relate to truly omni-channel customer behaviour with 46% of them fulfilled online and 32% in store. In total, 38% of the visits to advertiser websites prompted by mail converted into online purchases.

- However, the latest results from JICMAIL not only confirm mail's role in helping businesses hit their short-term sales targets, but they also highlight mail's role in delivering upper funnel KPIs. Reach, Frequency and now Attention are the cornerstones of brand campaign planning, enabling marketers to plan for maximum opportunity-to-see and advertising engagement. With mail frequency of interaction up year on year for Direct Mail, Door Drops and Partially Addressed Mail (PAM), mail generated more ad impressions in Q1 2024 than a year ago.

- Mail Attention continues to be a vital upper funnel planning KPI and is more important than ever in an era of heightened digital ad fraud. With the average piece of Direct Mail generating 134 seconds of attention across all household members in a 28 day period, and the average Door Drop 55 seconds, mail is a highly attention efficient channel.

- The cost of generating a minute of ABC1 Adult attention now stands at £0.11 for Direct Mail and £0.07 for Door Drops - a better rate of attention efficiency than with both social and digital display.

- The amount of mail being filed away in the home reached a three-year high in Q1 2024. One fifth of mail is now being actively retained in the home by being filed away by consumers, including financial statements, notifications and reminders and special offers. The willingness of consumers to retain physical marketing messages in an era of cross-platform ad saturation is a vital opportunity for marketers to capitalise upon.

- With an election looming in July, JICMAIL's recent From Letterbox to Ballot Box webinar highlighted the important of the mail channel in delivery vital political messages in an era of declining trust. These findings are again highlighted with the release of Q1 data. Direct Mail attention to political messages climbed 59% while 11% of Door Drops from political parties stimulate a discussion in the household.

- The NHS, Santander, FarmFoods and The Conservative Party commanded a disproportionately large share of attention compared to their share of mail volumes in Q1 2024, highlighting the importance of mail creative and content when optimising mail efficiency and effectiveness. The ability to now track whether mail is received by existing customers on the JICMAIL panel reveals that Hello Fresh, ROL Cruises and the AA were among the most prominent users of cold DM in Q1 2024.

- Key mail metrics for Q1 2024 can be summarised as follows:

|

|

Frequency |

Item Reach |

Lifespan |

Attention |

|

Direct Mail |

4.4 interactions |

1.12 people |

7.0 days |

134 seconds |

|

Door Drops |

3.1 interactions |

1.06 people |

5.8 days |

55 seconds |

|

Business Mail |

4.7 interactions |

1.16 people |

8.3 days |

175 seconds |

|

Partially Addressed |

4.1 interactions |

1.10 people |

6.3 days |

92 seconds |

|

% of ALL Mail… |

Read / looked / glanced at |

Opened |

Filed Away |

Prompted a purchase |

Prompted a website visit |

Prompted a discussion |

|

Q1 2024 |

75.9% |

64.7% |

20.2% |

6.0% |

8.0% |

15.7% |

|

Q1 2023 |

74.6% |

64.6% |

20.0% |

4.2% |

8.3% |

15.6% |

Source: JICMAIL Item Data Q1 2024 n=10,590 Direct Mail, Door Drop, Partially Addressed and Business Mail items

Mail interactions captured by JICMAIL panellists take many forms and range from opening and reading mail, to passing it on to someone else, putting it in the usual place, putting aside to look at later or taking it out of home (amongst a list of many other actions). In addition, JICMAIL captures the industry category and advertiser details of almost every mail item in its 314,000 strong mail item database.

Ian Gibbs, JICMAIL, Director of Data Leadership and Learning, said "Mail has continued to prove its impact at the sharp end of the consumer purchase funnel in Q1. Despite Google once again delaying the death of third party cookies, savvy marketers will be adapting their measurement efforts to reduce reliance on last-click-attribution models and instead move towards full-effect measurement techniques. The JICMAIL panel now reports on a range of omni-channel purchase actions, painting a fuller, more accurate picture of mail effectiveness."

Mark Cross, Engagement Director of JICMAIL added, "Another set of results that demonstrate the powerful total effects from mail with more interactions, more attention and deepening effectiveness presenting opportunities for smart solutions that fully exploit them. Our recent work on political campaigns also highlights the unique properties of mail for the political parties to get their messages read and discussed in the home, a stand-out 'democratic' effect in a new era of mis-information elsewhere."

Downloads Growth in output and orders ramped up in Q3 alongside boost in confidence - stronger growth forecast to hold in Q4

Growth in output and orders ramped up in Q3 alongside boost in confidence - stronger growth forecast to hold in Q4

7 November 2024

The pace of growth in output and orders picked up in Q3 as the UK's printing and printed packaging industry benefitted from a previously delayed boost in confidence materialising in the third quarter of 2024.

Pay Review and Wage Benchmarking - NEW UPDATE

Pay Review and Wage Benchmarking - NEW UPDATE

11 November 2024

We have collated data from multiple sources that should be useful for BPIF members that are approaching internal pay reviews, and/or are having a closer look at their pay and benefits structure.