11 September 2024

The General Election drives a 12% increase in JICMAIL panel volumes in Q2 2024

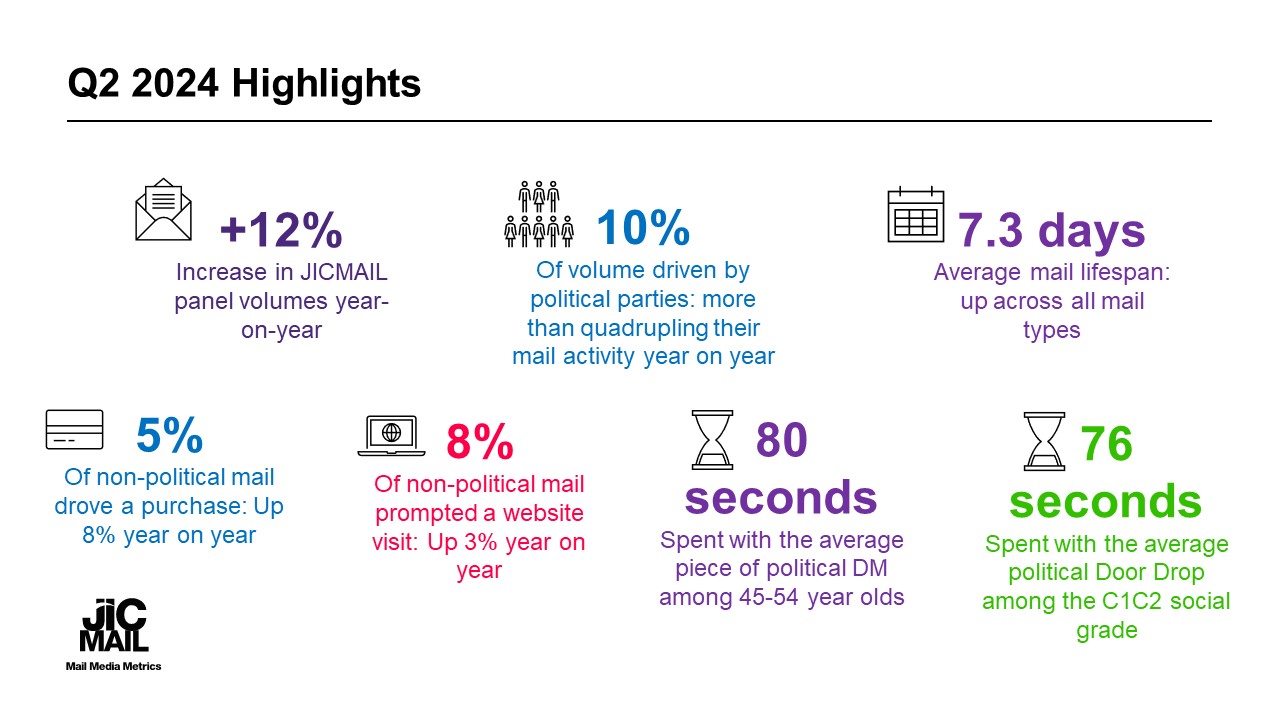

JICMAIL - The Joint Industry Currency for Mail - has revealed that volumes tracked on its panel increased by 12% in Q2 2024. Mail from political parties in the run up to the General Election accounted for 10% of volumes which more than quadrupled year-on-year. Volume growth was also driven by the travel and retail sectors, painting a healthy picture of cross-sector confidence in the mail channel.

- While advertiser activity saw a welcome return to volume growth in the mail channel, consumers also responded with higher levels of mail engagement. Mail lifespan and attention increased year-on-year across all mail types: Direct Mail, Door Drops, Business Mail and Partially Addressed Mail.

- The average piece of Direct Mail was retained in the home for 7.3 days on average (up 4% year on year) and generated 132 seconds of attention. The average Door Drop stayed in the home for 5.9 days (up 3%) and was engaged with for a minute on average.

- Non-political mail also continued its upward trajectory in terms of commercial effectiveness, with the amount of mail stimulating a purchase reaching 5.3% (up 8% year on year) and the proportion generating website visits increasing to 8% (up 3% year on year)

- Over half (51%) of mail that drove a purchase did so online - the highest reading of this metric since purchase channel was split out by JICMAIL in Q3 2023. Mail from the utilities and financial services sectors was the most likely to prompt an online purchase.

- The General Election-fuelled increase in panel volumes was the big story of the quarter however: Direct Mail from political parties increased by 343% year on year while political Door Drops increased by 324%.

- The ability of the mail channel to stimulate vital conversations within the household proved to be one of the key positive outcomes for political parties who invested in the channel. 14.6% of political Direct Mail prompted a discussion, while for Door Drops the discussion rate was 11.9%.

- The relative strengths of the different mail channels were apparent when assessing which audiences paid the most attention to political mail. Younger audiences tended to pay more attention to political Door Drops than Direct Mail, as did C1C2 households. Direct Mail attention tended to be higher among 45+ year olds and was well distributed by social grade.

- While the political parties dominated mail volumes, mail from the NHS proved to generate the highest share of attention in Q2 2024.

Mail interactions captured by JICMAIL panellists take many forms and range from opening and reading mail, to passing it on to someone else, putting it in the usual place, putting aside to look at later or taking it out of home (amongst a list of many other actions). In addition, JICMAIL captures the industry category and advertiser details of almost every mail item in its 325,000 strong mail item database.

Ian Gibbs, JICMAIL, Director of Data Leadership and Learning, said "It's exciting see confidence returning to the mail channel in Q2 2024, buoyed by strong mail engagement rates and commercial effectiveness. While the General Election played a huge part in stimulating volumes, this wasn't the only driver of growth however and it's encouraging to see retail and travel advertisers in particular using the omni-channel strengths of the mail channel to full effect."

Mark Cross, Engagement Director of JICMAIL added, "When it came to persuading potential voters in a particular constituency, to get their message read, engaged with and talked about in the home at a critical moment, the political parties turned to mail in droves. Some powerful cross category lessons and nuggets of insight available here for the wider industry!'"

For more information on how you can access JICMAIL data and use it to plan more efficient and effective mail campaigns, please visit www.jicmail.org.uk or email [email protected]

UK Printing - Sector Performance 1995-2023

UK Printing - Sector Performance 1995-2023

7 October 2024

We have produced an analysis of data from the Office for National Statistics providing a detailed product sector breakdown for UK manufacturer sales of printed products.

Packaging and labels vital to the strategic future of print

Packaging and labels vital to the strategic future of print

7 October 2024

Smithers forecasts +3.6% CAGR for $504.9 billion packaging print market in wake of Drupa 2024