5 March 2025

Mail read rates hit an all-time high in Q4 2024 as the channel continues to assert its Super Touchpoint strengths

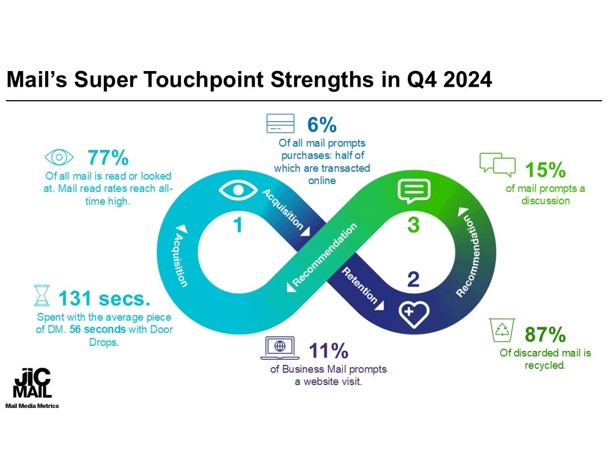

The latest quarterly results from JICMAIL reveal that 77% of mail (including Direct Mail, Door Drops and Business Mail) was read or looked at in the crucial Q4 trading period. This represents an all-time-high reading of this crucial engagement metric since JICMAIL began tracking consumer mail behaviours eight years ago.

JICMAIL - The Joint Industry Currency for Mail - has revealed that in the run-up to Christmas increased mail activity in the grocery and travel markets across all mail types, and across utilities, medical, finance and telecoms in the Door Drops sector, has captured the attention of consumers at a time of year when it is traditionally harder than ever for advertisers to cut through.

- With mail read-rates hitting a peak in Q4 2024, and year-on-year growth in frequency of interaction seen across Direct Mail, Door Drops and Business Mail, JICMAIL can report that the average DM piece is interacted with for 133 seconds across a 28 day period, while the average Door Drop generates 56 seconds of attention.

- The mail channel's ability to attract consumer attention and subsequently convert this attention into sales acquisitions is a vital component of its Super Touchpoint strengths, as outlined in the "Mail: The Super Touchpoint" report released at the JICMAIL Conference at PwC in January.

- 6% of mail prompted a purchase in the critical Q4 trading period, and testament to the seamless omni-channel strengths that are displayed by a Super Touchpoint, half of these purchases were transacted online. Supermarkets, retailers, charities and financial service products such as credit cards and pensions, recorded above-average response rates across both Door Drops and Direct Mail.

- Loyalty reward statements proved to be one of the most effective drivers of response in the Direct Mail space, while for Door Drops, the use of vouchers and special offers was found to be particularly effective.

- Mail's ability to retain customers and deepen loyalty further speaks to the channel's Super Touchpoint strengths with Business Mail's growing impact in this space again in evidence in Q4. Business Mail frequency of interaction and lifespan in the home grew year-on-year for the third quarter in a row; while Business Mail attention levels hit an all-time-high reading of 191 seconds per mail item.

- According to JICMAIL-endorsed Nielsen circulation data 7,763 advertisers used Direct Mail or Door Drops in 2024, amounting to 15% of all UK advertisers tracked by Nielsen.

- The usual big-mail advertisers across the grocery and retail sectors (e.g. Tesco, Waitrose and Farmfoods and Hillarys) dominated spend alongside Christmas charity appeals (e.g. from Crisis and The Salvation Army). However, notable new entrants into the top ten rankings included Our Future Health, proving that the use of mail in a sensitive market such as the medical sector is vital where trust levels in the medium and message are of paramount importance.

Key mail metrics for Q4 2024 can be summarised as follows:

|

|

Frequency |

Item Reach |

Lifespan |

Attention |

|

Direct Mail |

4.4 interactions |

1.13 people |

7.0 days |

133 seconds |

|

Door Drops |

3.1 interactions |

1.06 people |

5.7 days |

56 seconds |

|

Business Mail |

4.8 interactions |

1.17 people |

8.6 days |

191 seconds |

|

Partially Addressed |

3.8 interactions |

1.09 people |

6.2 days |

80 seconds |

|

% of ALL Mail... |

Read / looked / glanced at |

Recycled (base: discarded mail) |

Prompted a purchase |

Prompted a discussion |

Prompted a website visit |

|

Q4 2024 |

77% |

87% |

6% |

15% |

8% |

|

Q4 2023 |

76% |

80% |

6% |

15% |

8% |

Source: JICMAIL Item Data Q4 2024 n=9,875 Direct Mail, Door Drop, Partially Addressed and Business Mail items

Mail interactions captured by JICMAIL panellists take many forms and range from opening and reading mail, to passing it on to someone else, putting it in the usual place, putting aside to look at later or taking it out of home (amongst a list of many other actions). In addition, JICMAIL captures the industry category and advertiser details of almost every mail item in its 345,000+ strong mail item database.

Ian Gibbs, JICMAIL, Director of Data Leadership and Learning, said:

"Everyone knows that the competition for consumer eyeballs is more fierce than ever in Q4. Combined with the ongoing challenges of platform dominated ad spend, persistent use of last-click attribution models, and rising levels of digital ad fraud, it is more important than ever for marketers to consider their investments in Super Touchpoints in this crucial trading period. Mail has again proven its strengths throughout the purchase cycle in Q4 and the record levels of mail read-rates show just how much appetite consumers have for marketing comms delivered through the mail channel."

Mark Cross, Engagement Director, JICMAIL added:

"The power of mail as a Super Touchpoint across the most critical trading season of the year for many was apparent again in this season. The question to ask for non-users is what reward did you sacrifice by not using mail when your competitive users converted 133 seconds of attention from direct mail into response rates just not achievable in digital."

For more information on how you can access JICMAIL data and use it to plan more efficient and effective mail campaigns, please visit www.jicmail.org.uk or email [email protected]

Downloads

Simpler Recycling Requirements in England

Simpler Recycling Requirements in England

21 January 2025

In order to increase recycling rates the government has introduced measures to simplify workplace recycling in England.

POSITIVE Q4 OUTPUT AND ORDERS GROWTH IN-LINE WITH FORECAST – BUT A NOSEDIVE IN CONFIDENCE HAS DEPRESSED EXPECTATIONS FOR Q1

POSITIVE Q4 OUTPUT AND ORDERS GROWTH IN-LINE WITH FORECAST – BUT A NOSEDIVE IN CONFIDENCE HAS DEPRESSED EXPECTATIONS FOR Q1

6 February 2025

Output and orders in Q4 more-or-less performed as forecast as the UK's printing and printed packaging industry continued its path of steady, but subdued, growth in 2024.