7 November 2017

Interest rates increase to 0.5%

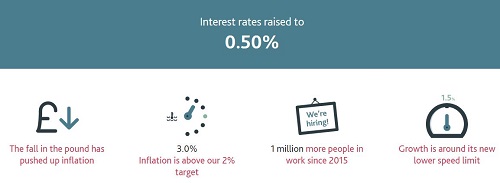

The Bank of England's Monetary Policy Committee (MPC) increased interest rates to 0.50% on Thursday 2nd November 2017.

Inflation is above the 2% target, because of the sharp fall in the pound triggered by the EU referendum. The bank has to balance how quickly they take inflation back to the target with the support given to jobs and activity. With more people in work and growth in the economy steady, there are limits to the extent to which the bank can accept above-target inflation. People need to be able to rely on low and stable inflation. To make sure of that, the UK needs to keep economic growth around it's new, lower, speed limit.

To ensure a sustainable return of inflation to the target the bank has raised interest rates from 0.25% to 0.5%. That means reducing slightly the amount of support they are providing to the economy. Further rises are expected to happen at a gradual pace and to a limited extent. Interest rates are likely to remain substantially lower than a decade ago.

"With unemployment at a 42-year low, inflation above target and growth just above its new, lower speed limit, the time has come to ease our foot off the accelerator"

Read more about the decision behind the increase on the bank's new, infographic led, and Inflation Report website below.

Downloads WIDE-FORMAT FORECAST FOR PRINTING

WIDE-FORMAT FORECAST FOR PRINTING

8 January 2025

Keypoint Intelligence Forecast Conveys Growth Patterns, Technology Shifts, and Market Opportunities in the Wide Format Industry.

Simpler Recycling Requirements in England

Simpler Recycling Requirements in England

21 January 2025

In order to increase recycling rates the government has introduced measures to simplify workplace recycling in England.