19 January 2018

Brexit and the UK Printing Industry

With a turnover of £13.8 billion (2016) and employing around 116,000 people in 8,400 companies, the UK printing sector is an important economic contributor and employer in all UK regions.

The UK is the fifth largest printing county in the world (after USA, China, Japan and Germany).

But what has Brexit got to do with the UK Printing Industry?

Trade in Printed Products

Printed matter contributed £775 million to the UK's balance of trade in 2016. Approximately 50% of exports are to the EU – £1.4bn of £2.9bn. Whilst only 35% of imports are from EU - £0.8bn of £2.2bn. Almost all of the positive trade balance is as a result of EU trade.

It is worth noting that in many cases it is not the printer that is doing the exporting - but the clients they are printing for. However, this trade is important – much of it is to Ireland (a particularly important market for companies based in Northern Ireland) but there are also very significant exports to the rest of Europe and further afield to the USA.

Supply Chain

Importantly, there is also a significant amount of trade in the supply chain. The major material input is of course paper and board – almost all of which is imported (80% from Europe).

Of course a number of companies now have employees that have moved from elsewhere in Europe. And investment in capital, technology, software etc. is a worldwide market.

BPIF Research on Brexit

In a pre-referendum survey the general feeling was that it would be better for business to remain in the EU.

A post-referendum survey suggested that companies held the impression that the overall effect would be a negative impact upon business.

In both research projects opinions were polarised and not lacking in emotive input.

Threats

Some threats surrounding Brexit are: uncertainty, exchange rate fluctuations, supply chain security and the subsequent impact on costs and profits.

Opportunities

There may also be some opportunities: change in economy to exploit, interest rates lower for longer, exporting competitiveness and import replacement.

However, as a warning to the Government's negotiators and those that are tempted to place excessive reliance on what's going on with exchange rates – exchange rates are temporary; tariffs are not!

The BPIF Brexit Barometer

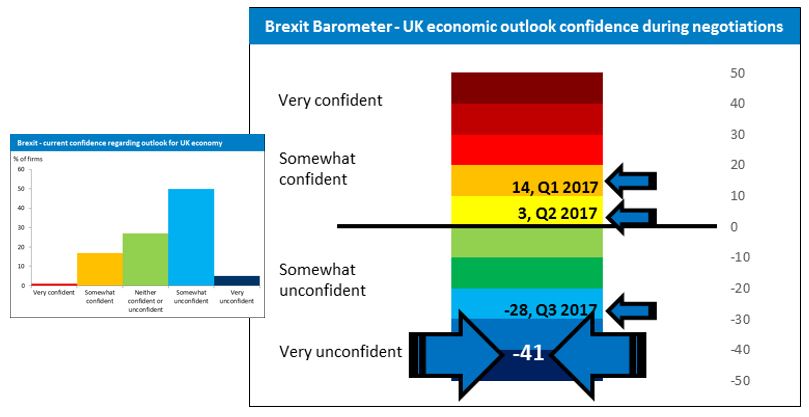

The BPIF is currently monitoring Brexit confidence through our quarterly Printing Outlook survey. We are currently asking companies to indicate their current level of confidence regarding the outlook for the UK economy during the Brexit negotiation period.

The small chart shows the response dispersion between the different response categories –from very confident to very unconfident.

The responses are then weighted and scaled so that we can easily monitor over time and produce the larger barometer chart – where we can see that the current overall balance is a score of -41 – in the 'very unconfident' zone.

You can see from the Barometer that the initial responses did display more confidence, unfortunately this has ebbed away.

We will continue to monitor Brexit confidence in Printing Outlook – and we will use the information collected within that, together with our other research to represent the industry and lobby on its behalf.

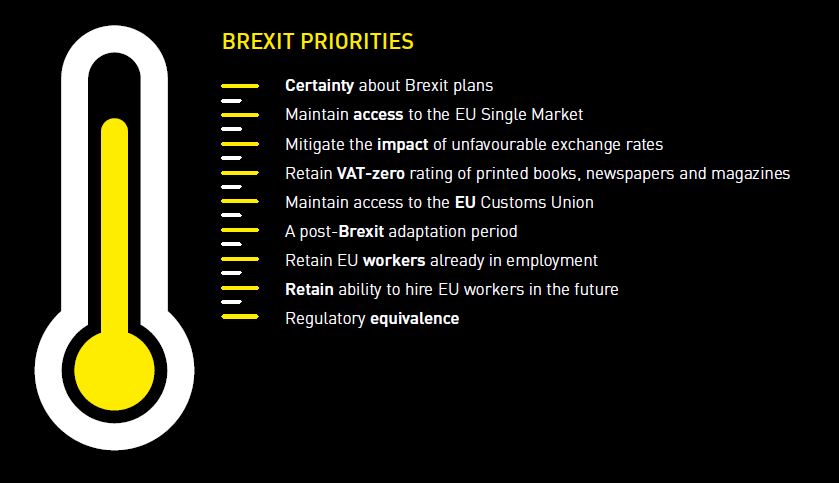

The image below is taken from our latest Priorities for Print brochure (one of main lobbying documents) – which went to MPs and Lords last year.

Top Considerations for Government from BPIF members regarding Brexit negotiations were:

- Retaining the ease of UK-EU trade.

- Developing a clear strategy for international trade and economic agreements.

BPIF members are keen to have:

- Certainty and clarity about Brexit plans.

- Progress on the issues surrounding the Northern Ireland/Republic of Ireland border.

- A post-Brexit adaption period.

As negotiations progress we will be having a closer look as to how the likely outcomes will affect the UK printing industry.

Have you made any specific Brexit contingency plans? Do you have any particular concerns or observations?

Please contact Kyle Jardine to discuss further.

Downloads Simpler Recycling Requirements in England

Simpler Recycling Requirements in England

21 January 2025

In order to increase recycling rates the government has introduced measures to simplify workplace recycling in England.

WIDE-FORMAT FORECAST FOR PRINTING

WIDE-FORMAT FORECAST FOR PRINTING

8 January 2025

Keypoint Intelligence Forecast Conveys Growth Patterns, Technology Shifts, and Market Opportunities in the Wide Format Industry.