13 March 2018

What is the future for commercial digital printing?

Is your digital colour business growing faster or slower than your peers'?

Are you taking full advantage of new business opportunities enabled by production colour digital printing?

What new applications are driving the market?

You can easily find out by participating in Caslon's bi-annual market survey (in partnership with PODi). This year's survey takes about 15 minutes to complete.

As a survey participant you will receive:

- a FREE copy of the survey results for your industry segment

- a £50 Amazon Gift Certificate (for the first 50 respondents)

Since 2007, Caslon & Co (the management company for PODI – the digital printing trade association www.podi.org) has been conducting research to better understand the production digital printing market. This year they are researching in the UK and Western Europe to determine the latest trends in digital printing applications and business strategies.

Your individual results are strictly confidential. Data is only reported in aggregate.

The survey is meant for companies that print for pay (commercial printers, quick printers, digital printers, direct mailers, service bureaus) or conduct in-house printing for an organisation (in-plants or data centers). The survey is not meant for wide format, screen printers, or packaging printers.

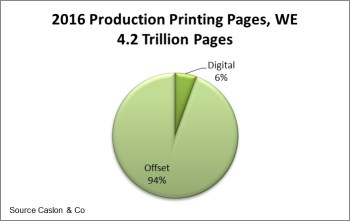

Here are some highlights from last year's report. The market size for production digital printing (as measured in A4 simplex pages) is roughly only 6% of the total 4.2 trillion page production market in Western Europe. So there's plenty of room for growth to continue.

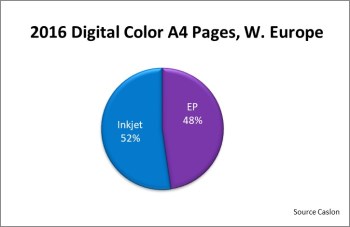

The growth has all been in production colour as volumes have increased between 15% and 20% for ten years in a row, while monochrome digital has declined 2%-5% per year. What's new is how the growth in colour digital printing has been occurring. If we look back 5-10 years ago the growth engine was toner-based cutsheet presses. However, while cutsheet toner output is still growing in the 5% to 10% range, inkjet output is now growing at 20%-25% per year. Inkjet output now comprises over half of the total digital color printing output.

With page volumes increasing and pricing for digital output holding steady the market for digital colour printing continues to be a nice growth opportunity for printers.

This year's survey takes a look at purchase intent, investment opportunities and growth strategies. To get your copy please participate in the survey – using the link below – Caslon are running on behalf of PODI.

(Note: this not a BPIF survey but we have previously collaborated with Caslon and PODI by promoting their relevant industry research.)

Downloads

WIDE-FORMAT FORECAST FOR PRINTING

WIDE-FORMAT FORECAST FOR PRINTING

8 January 2025

Keypoint Intelligence Forecast Conveys Growth Patterns, Technology Shifts, and Market Opportunities in the Wide Format Industry.

Simpler Recycling Requirements in England

Simpler Recycling Requirements in England

21 January 2025

In order to increase recycling rates the government has introduced measures to simplify workplace recycling in England.