22 November 2018

Northern Ireland output rises but confidence continues to slide

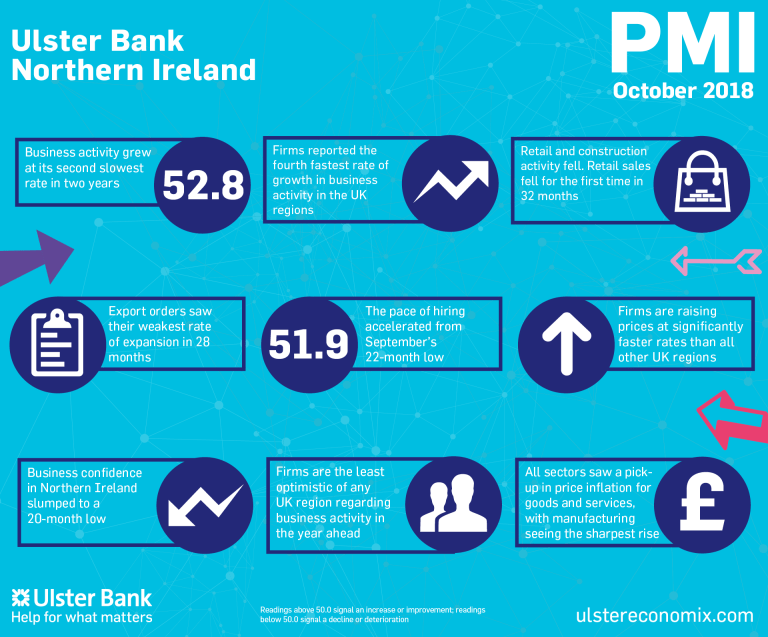

The latest Ulster Bank Northern Ireland PMI report - produced for Ulster Bank by IHS Markit - pointed to a slight pick-up in growth in October, with both output and new orders rising more quickly than in September. Rates of expansion were still weaker than seen earlier in the year, however. The rate of job creation also ticked up, but business sentiment dropped to the weakest in the 20-month series history. On the price front, both input costs and output prices increased at sharper rates amid higher costs for a range of inputs.

Commenting on the latest survey findings, Richard Ramsey, Chief Economist Northern Ireland, Ulster Bank, said:

"Northern Ireland was the only region of the UK to see private sector growth pick up in October. However, this sounds much better than it actually is. The pace of expansion remained subdued, and two of the four sectors surveyed - retail and construction - actually saw a contraction last month. But perhaps the most significant finding of the survey is that Northern Ireland firms reported a large drop in confidence looking 12-months ahead. Retail, construction and services are now their least optimistic at any time in the past 20-months, when this indicator started to be tracked.

"The mounting pessimism in the latest survey largely relates to the construction sector. Last month, construction activity fell for the first time in 15-months and at the sharpest rate since November 2016. Unlike their counterparts in the UK, Northern Ireland construction businesses are also seeing their order books shrink - at the fastest rate in 22-months - and this is leading to a decline in optimism. The lack of decision-making in government in Northern Ireland and the resulting logjam in capital projects is now being acutely felt by many construction businesses.

"More positively, the manufacturing sector continues to experience strong demand, despite a slowdown in export orders. Unsurprisingly therefore, manufacturers remain the most optimistic about the year ahead. Clearly, the big factor that will determine whether this optimism is realised is how Brexit pans out. The outcome of the negotiations will determine the trajectory of private sector growth in Northern Ireland into the foreseeable future, particularly in the export-focused manufacturing sector. Today, forecasting growth means forecasting politics."

The main findings of the October survey were as follows:

The headline seasonally adjusted Business Activity Index posted 52.8 in October, up from 52.1 in September and pointing to a solid monthly increase in private sector business activity in Northern Ireland. Output has now increased in each of the past 25 months. Where activity increased, panellists linked this to higher new orders. The manufacturing and service sectors recorded increases in output during the month, led by manufacturing. In contrast, declines were seen in construction and retail activity. In line with the trend in output, new business increased at a slightly faster pace in October as companies were able to secure new customers amid some improvements in demand.

Companies were able to work through outstanding business for the third month running, but to the least extent in this sequence. Higher staffing levels contributed to the reduction in backlogs of work, with employment increasing for the forty-fifth successive month at the start of the fourth quarter. Panellists indicated that extra staff were hired in response to increasing new orders. Input prices continued to rise sharply in October, with the rate of inflation ticking up from September. Panellists reported higher costs for transport, staff, electricity and fuel. The passing on of higher input costs to customers resulted in a marked increase in output prices. The latest rise was the sharpest in four months and much faster than the UK average. At the sector level, manufacturers posted the steepest increase in selling prices.

Confidence regarding the 12-month outlook for activity waned in October and was the lowest since the series began in March 2017. Political uncertainty and Brexit were the main factors leading optimism to weaken. Sentiment was down across all four monitored sectors.

Source: Richard Ramsey, Chief Economist Northern Ireland, Ulster Bank.

Downloads Simpler Recycling Requirements in England

Simpler Recycling Requirements in England

21 January 2025

In order to increase recycling rates the government has introduced measures to simplify workplace recycling in England.

POSITIVE Q4 OUTPUT AND ORDERS GROWTH IN-LINE WITH FORECAST – BUT A NOSEDIVE IN CONFIDENCE HAS DEPRESSED EXPECTATIONS FOR Q1

POSITIVE Q4 OUTPUT AND ORDERS GROWTH IN-LINE WITH FORECAST – BUT A NOSEDIVE IN CONFIDENCE HAS DEPRESSED EXPECTATIONS FOR Q1

6 February 2025

Output and orders in Q4 more-or-less performed as forecast as the UK's printing and printed packaging industry continued its path of steady, but subdued, growth in 2024.