4 December 2018

Prismm Environmental and the BPIF recycled paper market update – November 2018

As mentioned in the price report in October, the price of certain paper grades was expected to fall in November and it did.

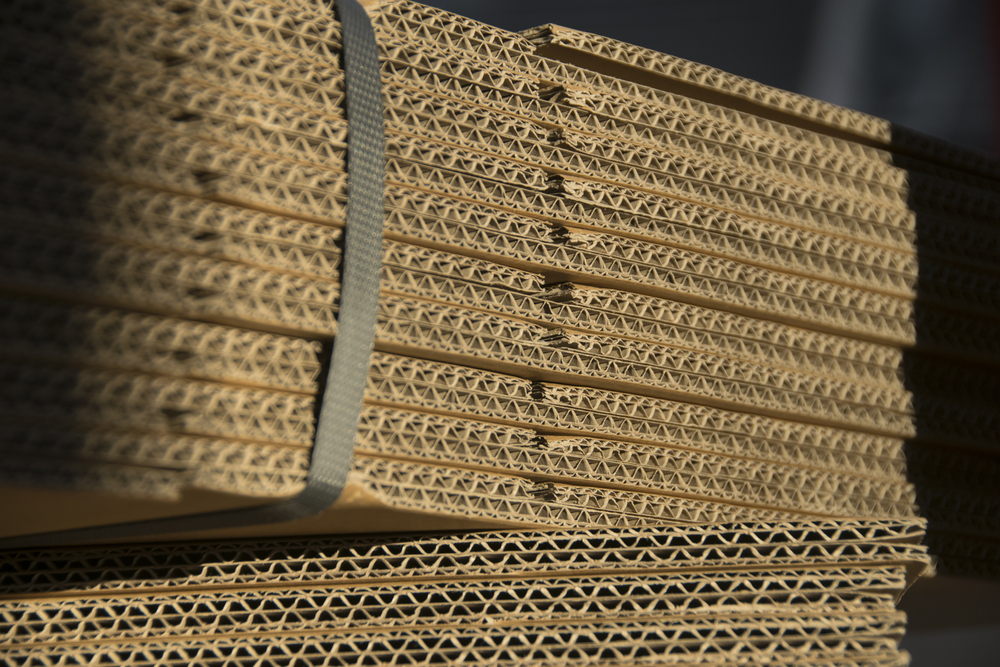

Prices for clean cardboard boxes declined throughout the month. At the top end of the market, bales of cardboard that met Chinese specification (effectively just clean, baled cardboard boxes) were able to command £95 to £110 having been above £160 per tonne in October.

Other destinations were largely stable at lower prices than these, although it was increasingly clear that UK and European mills were fully stocked and so were out of the market.

Mixed paper grades also dropped a little at the top end as this UK and European demand that had previously sustained the price, waned a little.

There was no change for scan or laminated board prices.

Looking forward into December, a lot will depend on the confidence of the market. With the Christmas production rush over, UK and European paper mills are expected to retain their traditional quiet purchasing patterns for this time of year.

Much will therefore depend on whether major Chinese mill groups and their buyers have the confidence to purchase for 2019. This is because there are fears import quotas for paper and cardboard may be cut by potentially around a third by the Chinese Government next year.

Until they know how much they can import, the Chinese mill groups seem certain to remain cautious. With the first quota levels expected in January, it looks likely that demand and prices may be subdued for cardboard and paper for recycling.

However, if prices stay this low and possibly fall futher, and if exchange rates and shipping are benign, then it could be the Chinese decide to take the risk and buy now to arrive in early 2019.

Whatever happens, the end of 2018, beginning of 2019, looks set to be an uncertain period for the cardboard/paper recycling market.

November price ranges*

Cardboard £65 to £110

Scan board £120 to £180

Laminated board £10 to £35

Mixed and BBC £35 to £50

* depending on quality and destination

For more detailed information, please contact Prismm Environmental www.prismm.co.uk

Simpler Recycling Requirements in England

Simpler Recycling Requirements in England

21 January 2025

In order to increase recycling rates the government has introduced measures to simplify workplace recycling in England.

POSITIVE Q4 OUTPUT AND ORDERS GROWTH IN-LINE WITH FORECAST – BUT A NOSEDIVE IN CONFIDENCE HAS DEPRESSED EXPECTATIONS FOR Q1

POSITIVE Q4 OUTPUT AND ORDERS GROWTH IN-LINE WITH FORECAST – BUT A NOSEDIVE IN CONFIDENCE HAS DEPRESSED EXPECTATIONS FOR Q1

6 February 2025

Output and orders in Q4 more-or-less performed as forecast as the UK's printing and printed packaging industry continued its path of steady, but subdued, growth in 2024.