13 January 2020

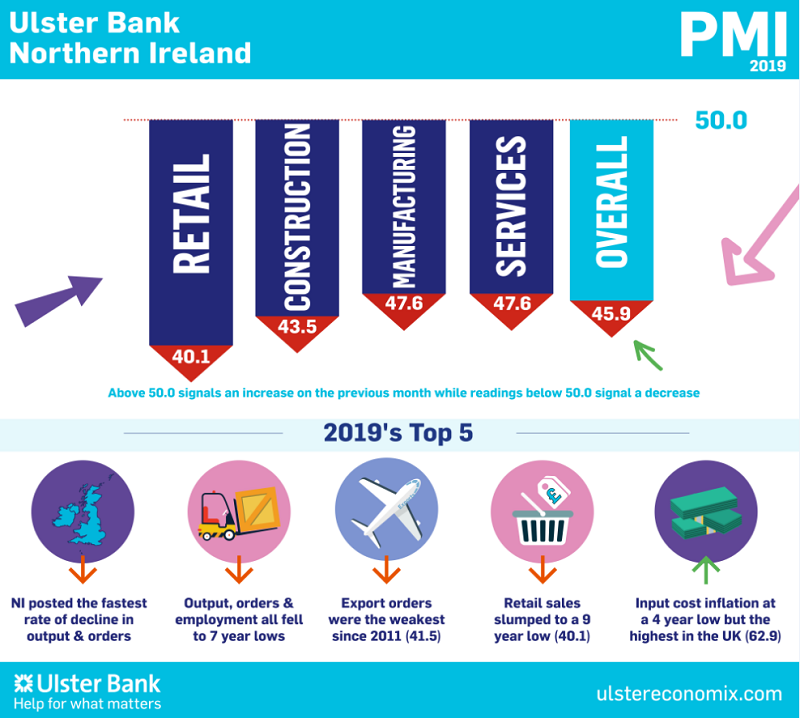

Northern Ireland PMI – business activity declines for tenth month running at end of 2019

The latest Ulster Bank Northern Ireland PMI® report – produced for Ulster Bank by IHS Markit – signalled further reductions in output and new orders, but rates of decline softened in December. Meanwhile, companies increased their staffing levels for the first time in a year and confidence regarding the 12-month outlook for activity improved amid reduced uncertainty around Brexit. On the price front, the rate of input cost inflation softened again and companies lowered their output prices for the first time in over four years.

Commenting on the latest survey findings, Richard Ramsey, Chief Economist Northern Ireland, Ulster Bank, said:

"Northern Ireland's private sector ended the decade in the same manner as it began. Like 2010, last year was one of decline and underperformance albeit not as stark as the last deep recession. Local firms posted the fastest rates of contraction in output and orders of all the UK regions. 2019 was also the weakest year for private sector output, orders and employment growth in seven years. Meanwhile, export orders shrank at their fastest pace since 2011. Manufacturing and services firms posted their first annual fall in output since 2012. However, the pace of decline was more marked for both construction and retailers with the latter seeing sales slump to a nine-year low.

"While firms continued to report sharp rates of decline in output and orders in December and for the fourth quarter, there are some signs that Northern Ireland's downturn is easing. Brexit uncertainty dogged private sector performance throughout 2019 but there has been a notable pick-up in sentiment in Q4. Greater clarity around Brexit and political direction following the General Election is a factor. All sectors have become more optimistic about the year ahead with retailers the only sector not anticipating growth over the next twelve months. Significantly, construction firms expect activity to increase over the next year for the first time in 18 months. December also revealed that staffing levels rose for the first time in 12 months. Though one indicator worth watching in the year ahead is profitability. Firms have reduced the prices of their goods and services for the first time since October 2015. This will squeeze profitability and put pressure on headcount if demand doesn't pick up.

"Clearly signs of improvement are to be welcomed. However, significant challenges remain and Northern Ireland's private sector has started 2020 in a weakened state. The lack of a Stormont Executive has been compounding matters, with its absence recently creeping into a fourth year. Restoring the institutions has been a political imperative but it is also essential for the economy and for the delivery of public services. Brexit uncertainty has eased and the extreme pessimism has receded. But uncertainty and potentially adverse consequences on this front remain."

The main findings of the December survey were as follows:

The headline seasonally adjusted Business Activity Index rose to 44.2 in December from 42.3 in November. Although signalling a softer pace of decline than in the previous month, the latest reading indicated that output still fell markedly at the end of 2019. A reluctance among customers to spend and uncertainty around Brexit continued to impact negatively on business activity. The fall in output in Northern Ireland remained much sharper than the UK average. New orders also fell again at Northern Ireland companies in December amid market uncertainty. That said, the rate of decline was the softest since last May amid a weaker reduction in new business at service providers.

Further reductions in new orders meant that companies were again able to deplete backlogs of work in December. The reduction in outstanding business was also helped by a marginal increase in employment. The rise in staffing levels was the first in 12 months, and often attributed to the hiring of additional sales staff.

The rate of input cost inflation softened for the fourth successive month and was the weakest for three-and-a-half years. That said, the rise was still marked amid reports of higher staff costs. Meanwhile, companies in Northern Ireland lowered their selling prices for the first time since October 2015. According to respondents, the modest reduction in charges reflected competitive pressures and efforts to increase market share. Reduced Brexit uncertainty following the General Election and predictions of rises in new orders led to greater confidence among companies that output will increase over the course of 2020. Optimism was the strongest since January 2019.

Source: Richard Ramsey, Chief Economist Northern Ireland, Ulster Bank.

Downloads INTERGRAF OPENS APPLICATIONS FOR THE 2025 YOUNG TALENT AWARD

INTERGRAF OPENS APPLICATIONS FOR THE 2025 YOUNG TALENT AWARD

4 December 2024

Intergraf is pleased to announce that applications are now open for the 2025 Young Talent Award, an initiative designed to inspire and shape the future of the print industry. This year, the Award invites young talent to explore how print companies can effectively attract and engage younger generations to pursue careers in the print industry.

Intergraf Economic News (Paper Prices) - December 2024

Intergraf Economic News (Paper Prices) - December 2024

5 December 2024

Access the latest edition of the Economic Newsletter for the European Printing Industry for data on paper consumption, and pricing data for pulp, paper, and recovered paper.