3 March 2020

Smithers forecasts the global printing market to reach $874 billion in 2024

There will be a moderate increase in growth in the global print market across the next 5 years, as the industry adjusts to new product demands, more flexible business models, and a shift in geographic emphasis.

Smithers latest market report, The Future of Global Printing to 2024 forecasts the global printing market value will increase from $818 billion in 2019 to $874 billion by 2024, with a compound annual growth rate (CAGR) of 1.3% - illustrating that value-adding potential still exists. However, total print volumes will remain constant at around 49.5 trillion A4 prints or equivalents.

The worldwide print industry remains in a stage of transition, with an impetus to refocus on emergent market opportunities, especially in packaging print, and those segments where print service providers can adapt to deliver higher value, shorter run work.

Smithers' analysis for The Future of Global Printing to 2024 identifies the following major trends for the global printing industry over the next five years:

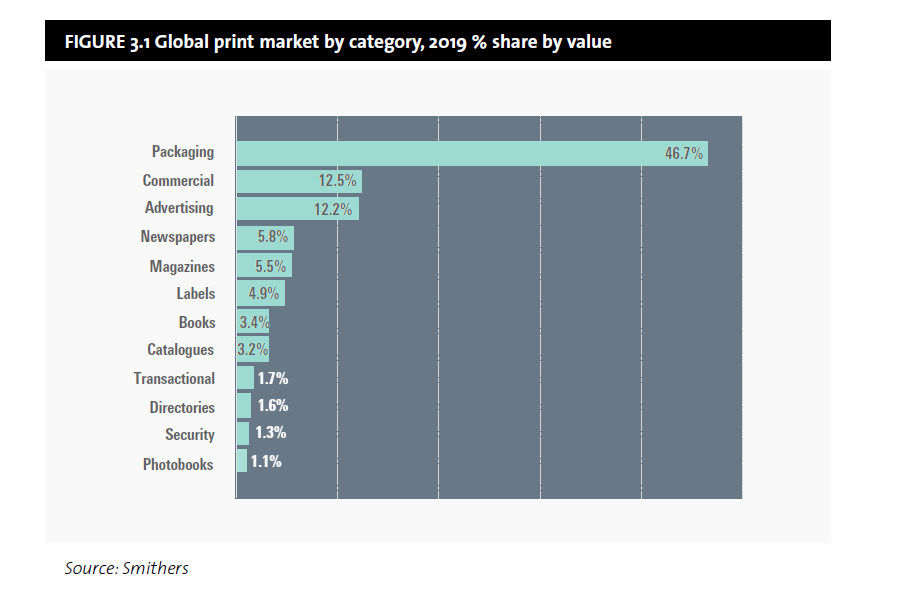

- Print demand continues to shift. Commercial print (advertising, promotional products, security, transactional mail, etc) is seeing declining volumes. As is most of publications print (newspapers, magazines, directories and catalogues, etc), although book printing is returning to growth. In contrast packaging and label work is booming. This is leading to a new focus from print service providers and the development of new equipment dedicated to specific packaging substrates.

- Print volumes are increasing quickest in transition economies. Of the fastest growing national print markets 2014-2024: three are in Latin America, three in Eastern Europe, two in the Middle East and Africa, and seven in Asia. In response OEMs and ink suppliers are globalising their sales forces and partnering with local firms.

- Print equipment sales will follow these broader market trends - overall equipment sales will fall marginally across the forecast period. Decline in demand for analogue systems will be highest, with genuine growth driven by a new generation of higher productivity inkjet machines, boosted by improving print quality that is eroding another barrier for transitioning to digital.

- The drive to digital production will be reflected in analogue equipment design, with greater automation of press operation and the moving of many finishing operations inline. Hybrid configurations are helping add greater flexibility to some analogue platforms - mainly flexo.

- OEMs are keen to diversify their equipment portfolio. The emphasis on inkjet systems means many are now finding new opportunities in functional and industrial print, including interior décor, electronics manufacture, 3D printing, and direct-to-object work. Overall this segment will grow at 7.0% year-on-year through to 2024.

New applications point to future success for print in the UK

The UK printing industry will continue to need to respond to changing demand for printed products to remain profitable as it enters the 2020s. This will include incorporating innovative technologies and exploiting new markets, according to the latest research from Smithers.

The Future of Global Printing to 2024 shows that in 2019 UK printing output was worth $26.0 billion in 2019, making it the fifth largest in the world. This value has fallen from $27.2 billion in 2014, however. Print volumes will continue to decline across the next five years, but print value will remain constant as more premium products are produced.

The UK remains the fifth largest national print market in 2019, but it will slip to sixth place, behind India in 2021.

The UK in context

The picture of stasis in the UK print market is reflected in other developed print markets, and it will outperform several other major European markets over the next five years. Through 2019 the UK suffered from ongoing uncertainty over the impact of Brexit. This saw sterling fall against both the euro and US dollar and a rise in raw material prices impacted print demand.

The Conservative victory in the December 2019 general election has given some clarity, even as national GDP growth flatlined at 0%. The nature of the UK's future trading relationship remains unresolved however. This has the potential for broader economic disruption that would impact print orders.

Globally moderate growth is forecast for print. Worldwide print value will increase at a rate of 1.3% year-on-year, from $826 billion in 2019 to $880 billion in 2024. This growth is driven by transition economies.

Of the 15 fastest growing print markets seven are located in Asia, three in Eastern Europe, three in Latin America, one in Africa and one in the Middle East. Over the next five years this will translate into a decline of equipment purchases worldwide, especially as a new generation of higher productivity come on stream. This is seeing print equipment providers refocus their sales activities on these growth regions.

Publication print

In the UK the mix of print products continues to evolve away from publications and graphics and towards packaging and labels work. This continues to negatively affect the demand for analogue - and gravure, cold and heatset litho in particular. Magazines, newspapers, directories, and catalogues are four of the six fastest declining end-use applications in the UK.

The collapse of Polestar in 2016 was emblematic of this trend, and it was joined by Netherlands-headquartered Circle Media Group (CMG) in April 2019. In response London-based Walstead Group has continued its consolidation policy with multiple acquisitions. It recorded a rise in revenues, but a drop of 8.9% in profits for 2018. On the continent Bertelsmann Printing Group has also announced plans to close its gravure print house at Nuremberg.

Other graphics applications - especially commercial print and transactional mail - will also see a fall in demand across the next five years.

Book print

The one publication print segment that has a brighter future is book printing. In the UK this will return to positive growth for 2019-2024 - the only non-packaging segment to do so. The resurgence of book printing is due principally to the arrival of digital print technologies.

High-volume inkjet presses linked to sophisticated slitting, cutting and folding finishing systems, are increasingly cost-competitive for both mono and colour titles. These offer efficiencies, such as on-demand digital printing, that can reduce waste and inventory costs; and minimises the risks for publishers in commissioning large print runs.

Digital print with inline finishing is aligning with a shift in the economics and response times demanded as more book sales move to e-commerce. Long-chain publishing allows copyright holders to advertise titles online, and only commission a print once an order is placed.

This creates premium for the printer, no risk for the publisher, and makes a much wider range of titles available to a reader.

Packaging and labels

The majority of growth for UK print service providers will come via increased work on packaging and labels. Worth just under 50% of the UK market in 2019, the market share for packaging and labels will rise to 55% in 2024.

Inkjet systems are becoming increasingly common in all sectors, following an initially proving in label work. In the label segment many OEMs are now developing existing narrow web platforms to also print flexible packaging substrates with HP Indigo, Xeikon, and Screen among the leaders. Demand from brand owners for greater sustainability in packaging is seeing more interest in flexible paper substrates in Europe, though this poses additional challenges for coating and surface uniformity.

For other packaging formats higher throughput digital machines for corrugated and folding cartons are now entering the market and greater productivity will be seen as more finishing is moved inline.

Embracing digital is an increasingly important for PSPs to unlock new revenues, offering innovative design concepts that can connect with customers. Requirements under the EU's Falsified Medicines

Directive for serialisation of pharmaceuticals will increase the need for printing unique codes on packs and labels; and the same technology -based on 2D data matrix codes - can be extended to brand protection functions in other higher value applications.

Print ordering will also increasingly move towards online portals, giving print buyers more direct control over designs and flexibility in choosing a PSP. This is enabling new business models. In the US ePac has rapidly grown to 28 sites offering 10-15 business day lead times flexible plastics commissions. In November 2019, it announced it was buying a further 24 HP Indigo 20000 presses to build its network outside North America. Two of these are being installed at its first European site in Northamptonshire in H1 2020.

Textiles and décor

Another segment that is expanding rapidly is functional and industrial printing. This includes printing on a range of unconventional substrates, and directly onto objects.

While the majority of work is still done on analogue machines (screen, gravure, and pad) the segment is being driven by new inkjet technology. The UK has helped pioneer several of the technologies for these systems, especially from the Cambridge Silicon Fen.

This is a diverse sector with a number of print systems integrated into industrial manufacturing, electronics production is for example the most lucrative functional and industrial print segment. Two applications that are accessible to mainstream PSPs are textile printing, and interior décor work on laminates and wallpaper stocks. These can initially be done on some wide format signage presses, and there are a rising number of web-to-print portals to enable interior designers to create and place order for bespoke designs with printers.

The outlook of the UK, European and world print industry across the five years to 2024 are explored in unparalleled detail in the Smithers study the Future of Global Print to 2024. The report analyses global demand for, and assesses the major influences on the printing market to 2024. This includes detail data segmentations by print process, end-use application, and national market; as well as data and forecasts on ink, substrate and machinery sales. This is presented in a comprehensive market data set, by value and volume, in over 350 data tables and figures.

This report covers the global markets for print and printed packaging, with the major consumable and new equipment supply markets. It is the latest edition of the report and the data presented here has been thoroughly re-evaluated with a significant research programme to ensure the highest degree of accuracy in a rapidly changing world.

Source: Smithers (especially provided to BPIF)

Downloads

INTERGRAF OPENS APPLICATIONS FOR THE 2025 YOUNG TALENT AWARD

INTERGRAF OPENS APPLICATIONS FOR THE 2025 YOUNG TALENT AWARD

4 December 2024

Intergraf is pleased to announce that applications are now open for the 2025 Young Talent Award, an initiative designed to inspire and shape the future of the print industry. This year, the Award invites young talent to explore how print companies can effectively attract and engage younger generations to pursue careers in the print industry.

Intergraf Economic News (Paper Prices) - December 2024

Intergraf Economic News (Paper Prices) - December 2024

5 December 2024

Access the latest edition of the Economic Newsletter for the European Printing Industry for data on paper consumption, and pricing data for pulp, paper, and recovered paper.